With higher vaccination coverage and loosening pandemic restrictions, most economies in Southeast Asia showed strong recovery momentum in the past year. In December 2022, the Asian Development Bank (ADB) gave out a supplement to its flagship Asian Development Outlook(ADO) 2022, which upgraded growth outlook for 2022 to 5.5% from 5.1% on robust economic performance in Malaysia, the Philippines, Thailand, and Vietnam in the third quarter. The report noted that the strong performance on consumption, exports and tourism in these economies boosted economic growth expectations for 2022.

Southeast Asia MDI Demand 2022

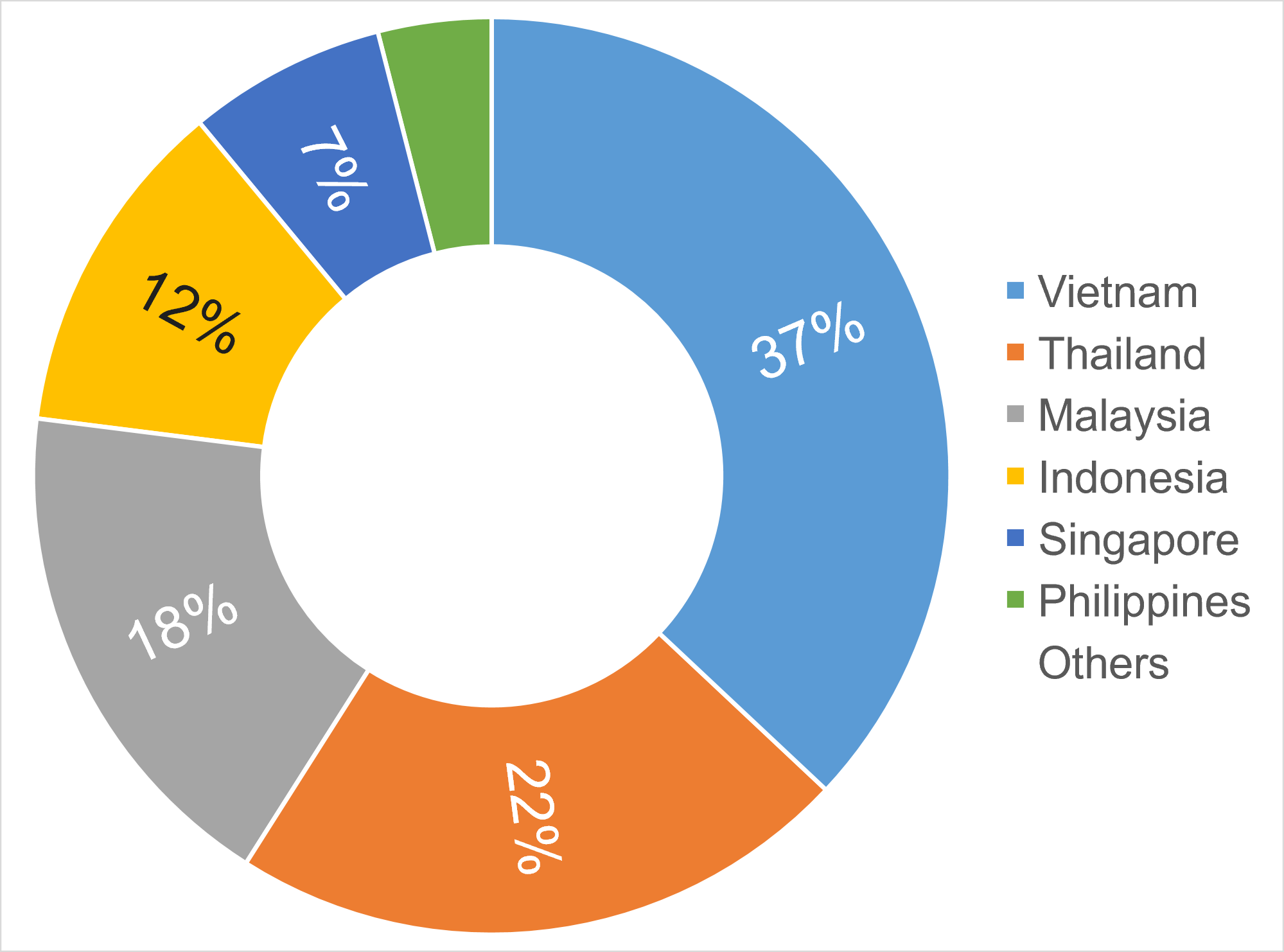

Without any MDI synthesizing facilities, Southeast Asia region mainly imports MDI products from China, Japan, South Korea and even from the Middle East and Europe. The major MDI suppliers include Chinese Wanhua Chemical, Japanese Tosoh, South Korean KMCI and BASF. Moreover, Middle Eastern firm Sadara’s PMDI is sold by Dow and SABIC. The supply of MDI exported from China, Japan and South Korea to Southeast Asia kept stable from 2018 to 2022. It is estimated that the total demand for MDI in Southeast Asia will be about 300kT in 2022, of which the demand for imported goods from China, Japan and South Korea will be around 260kT, basically the same as the previous year. Vietnam, Thailand and Malaysia are the top MDI consumers in Southeast Asia. In 2022, the year-on-year growth rates of MDI consumption in Vietnam and Malaysia were higher than the overall growth level of consumption in Southeast Asia.

Southeast Asian (Estimated) MDI Consumption by Country, 2022 (%)

Southeast Asian Major MDI Downstream Sectors

The main downstream sectors of PMDI in Southeast Asia are insulation panels, refrigerators & freezers, automobiles, etc. And the main downstream sectors of MMDI are PU resin for shoe sole and spandex. Vietnam, Thailand, Indonesia, Malaysia and Singapore are the top MDI consumers and also the major economies in the region. Southeast Asia countries have attracted significant foreign investment in recent years, owing to low costs on land and labor, stable political environment, robust economic development and preferential tariff rates.

Cold Chain Logistics (Insulation Panel): As one of the key strategic regions for global industrial transfer, the development of Southeast Asian countries is attracting much attention, and its cold chain logistics market is expected to grow by more than 12% in 2022-2027. Thailand’s refrigeration capacity totaled 940kT, and the refrigeration capacity of Indonesia and Myanmar was 370kT and 88kT respectively, according to a report of the Economic Research Institute for ASEAN and East Asia (ERIA). Increasing meat consumption is one of the main driving factor for the development of the cold chain industry in Southeast Asian countries. Malaysia’s poultry meat industry is largely self-sufficient, with an annual per capita consumption of nearly 50 kilograms.

Automobile: With a huge population and abundant natural resources, ASEAN is one of the fastest-growing consumer market, which, in turn, will drive the automobile market. From January to November 2022, auto outputs in ASEAN amounted to 4.06 million units, up 27.4% y/y. The top three auto producers are Indonesia, Thailand and Malaysia, contributing about 92.5% of total regional outputs. Thailand, the largest auto production base in Southeast Asia, produced 1.79 million vehicles from January to November 2022, up 16.9% y/y.

Summary:

The overall MDI consumption in Southeast Asia in 2022 kept unchanged compared with the previous year. It’s mainly because Southeast Asian manufacturing PMI is above 50% throughout the year and the demand in MDI downstream sectors didn’t weaken significantly. In addition, thanks to lower labor costs, more foreign-funded enterprises chose to enter the Southeast Asian market. In 2023, MDI consumption and its downstream sectors are projected to see a rise in Southeast Asia.

Part of Pudaily’s Asia Pacific MDI Market Report 2022- Catalogue

Chapter VI Southeast Asia & India MDI Market

6.1 Southeast Asia

6.1.1 Southeast Asia Macroeconomic Environment

6.1.1.1 Southeast Asian GDP

6.1.1.2 Southeast Asian PMI

6.1.2 Southeast Asia MDI Demand 2022

6.1.3 Southeast Asian Major MDI Downstream Sectors 2022

6.1.3 Southeast Asian MDI Market Prices 2022

6.2 India

6.2.1 India Macroeconomic Environment

6.2.1.1 India GDP

6.1.1.2 India PMI

6.2.2 India MDI Demand 2022

6.2.3 Indian Major MDI Downstream Sectors 2022

6.2.3 Indian MDI Market Prices 2022

Chapter VII Japan & South Korea MDI Markets

7.1 Japan

7.1.1 Japan Macroeconomic Environment

7.1.1.1 Japan GDP

7.1.1.2 Japan PMI

7.1.2 Japan MDI Supply & Demand

7.1.2.1 Japan MDI Capacity & Outputs 2022

7.1.2.2 Japan MDI Imports & Exports 2022

7.1.2.3 Japan MDI Demand 2022

7.1.2.1 Japan Major MDI Downstream Sectors 2022

7.2 South Korea

7.2.1 South Korea Macroeconomic Environment

......

If you are interested in the contents of the 2022 China TPU Market Report, please contact us for subscription.

Contact: Miss Kong Telephone: 15800430559 Email: kf@chem366.com