After the Spring Festival holiday, prices of a variety of chemical raw materials in China have begun to rise. The rally started earlier in the monomeric MDI(MMDI) market. Since last December, with the increase in operating rates of downstream manufacturers, the consumption and new orders for raw materials have increased, directly triggering the rebound of MMDI prices. In January, some Chinese MMDI suppliers controlled their supply. As logistics successively suspended operation before holidays, the negotiation and trading atmosphere weakened. However, MMDI prices still maintained a unilateral uptrend in the month.

Chinese MMDI market continued its rally in early February. On February 7, MMDI prices in China rose to CNY 19,300-19,500/tonne. Then the market has entered a consolidation mode in the past week. The trading mentality now is diverging. More speculative traders lower their offers to facilitate transactions, driving the price range to fluctuate. High and low prices coexist.

At present, the market is in turmoil. Will the rally continue? What to expect in the MMDI market in near future?

Supply: MDI facilities in Chongqing and Ningbo have been shut for maintenance this month, which contribute 27% of Chinese total MDI capacity. Moreover, as the maintenance time of Ningbo facility is later than in previous years, its supply has shrunk significantly year-on-year.

Demand: The main downstream industries of MMDI include TPU, spandex, PU resin for shoe sole and for synthetic leather. It’s reported that the effective operating rate of the spandex industry in China has been currently raised above 80%, and some manufacturers run nearly at full capacity; the operating rate of TPU industry is 60-70%, since the demand recovery in end products such as pneumatic tubes made some TPU manufacturers producing non-stop during the Spring Festival, and maintain a high operation load; the operating rates of PU resin for shoe sole and for synthetic leather industries are relatively lower, as consumer demand hasn’t revived markedly. With the arrival of peak production season, shoe sole and synthetic leather resin industries are predicted to see a boom in outputs and sales in March.

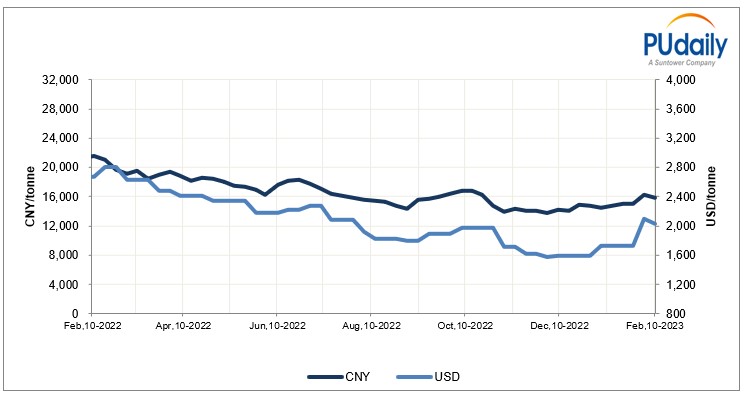

China MMDI Prices 2021 - 2023 (CNY/tonne)

Although suppliers in China, Japan and South Korea have raised their guide prices in the Chinese market for February, MMDI market prices still remain low compared to the previous two years, as shown in the figure above. Thanks to the recent supply shrinkage and expected increasing demand, the supply-demand gap is likey to gradually narrow, making China’s future MMDI market be consolidated at relatively high levels.