As a pioneer in the automotive industry, Europe has considerable influence and is also an indicator of car consumption. The EU is the main market in Europe, and the EU’s automotive industry occupies an important position in Europe’s economic development. Around 13 million Europeans work in the automotive sector, which accounts for 11.5% of all manufacturing jobs in the EU. The sector provides EUR 374.6 billion in tax revenue for European governments. Almost 8% of EU GDP is generated by the auto industry which also spends EUR 58.8 billion in R&D annually, 32% of the EU total.

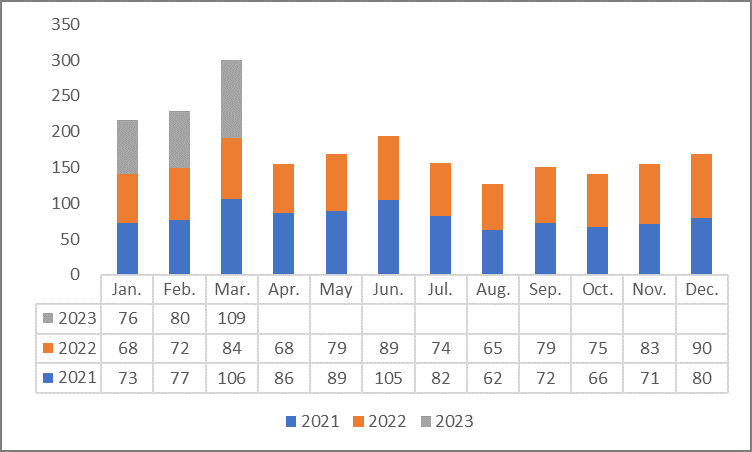

In March 2023, the EU car market recorded a significant 28.8% increase in passenger car registrations, surpassing more than a million units. All EU largest markets showed double-digit growth, led by Spain (66.1%) and Italy (40.7%). In the first quarter of 2023, EU car registrations grew by 17.9% from the same period in 2022 to almost 2.7 units, achieving a good start. Among the EU’s four major auto markets, Spain (+44.5%) saw the strongest gains, followed by Italy (+26.2%), France (+15.2%), and Germany (+6.5%).

Figure 1: New Passenger Car Registrations in the EU, 2021- 2023 (unit: 10,000 vehicles)

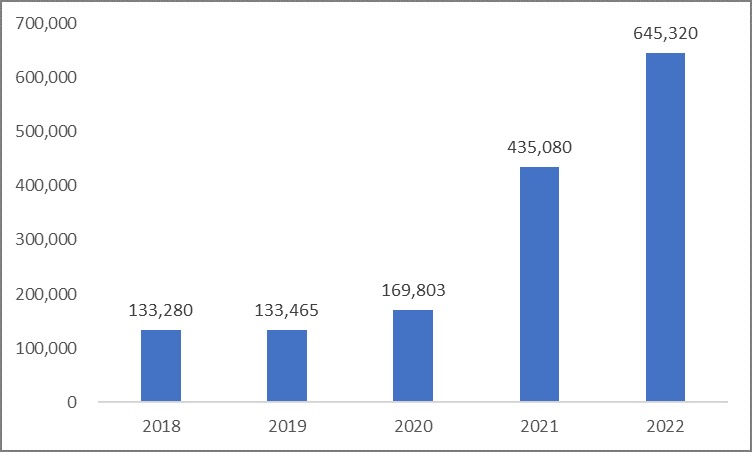

China’s auto exports have gradually expanded in recent years. Prior to 2020, countries such as Saudi Arabia, Bangladesh, and Egypt were the top export destinations for Chinese cars. In 2021, China optimized its structure, with auto export destinations mainly concentrated in Belgium, Chile, and Saudi Arabia. With new energy vehicles striding out of the country, Europe and North America are becoming two major incremental markets for China’s automobile exports. China is the EU’s second-largest trading partner, and the EU is also China’s second-largest trading partner. Therefore, Europe has become a “target market” for many Chinese automakers. Chinese EV makers such as BYD, MG, and NIO are all aiming at the European market. From 2018 to 2022, the number of passenger cars exported from China to Europe increased significantly, from 133,280 to 645,320, with a CAGR of 48.3%.

Figure 2: China’s Passenger Cars Exports to Europe, 2018-2022 (unit: vehicles)

The Eurozone Composite PMI rose to 54.4 in April 2023, the highest since May last year and well above market expectations of 53.7, a preliminary estimate showed. The Services PMI rose to 56.6 from 55 in the previous month and above market expectations of 54.5, indicating an increase in economic activities in the Eurozone and a recovery in consumer spending. In 2023, China’s export of polyether polyols is showing a continuous growth trend. In March, the export of other polyether polyols in primary forms from China to the EU increased by 26.15% year-on-year to 13,258 tonnes, and the total export in the first quarter of 2023 increased 71.69% year-on-year to 39,869 tonnes, which is a remarkable performance in the context of a weak global economy. With the sustained and benign development of the automotive industry, as an important downstream sector of polyether polyols, the demand for polyols in Europe is expected to further increase, which may boost China’s polyols exports to Europe and to some extent alleviate the problem of supply-demand imbalance caused by slow domestic demand growth and rapid capacity expansion in Chinese polyether polyols industry.