With shrinking exports and slowing economic growth, Vietnam’s trade deficit is gradually increasing, and it is expected to surpass USD 4.07 billion in the first three months of 2023. Vietnam’s GDP grew 3.32% year-on-year in Q1 of 2023, softer than a 5.92% rise in Q4 of 2022, and lower than market expectations of 4.8%, according to the General Statistics Office (GSO) of Vietnam. GSO stated that the slowdown in GDP growth is mainly due to a decrease in consumer demand, with Vietnam’s overseas sales in March shrinking by 14.8% year-on-year, and exports declining by 11.9% this quarter.

Vietnam is one of the world’s largest textile exporters, with the textile and footwear manufacturing industry being an important pillar of its economy. However, with Vietnam’s shrinking exports and slowing economic growth, this industry also faces significant challenges. Vietnam Textile and Apparel Association (VITAS) believed that this is mainly because the purchasing power in markets such as U.S. and EU is weakening significantly, resulting in fewer sales orders. In Q1 of 2023, textile and footwear orders in Vietnam fell 70%-80% year-on-year.

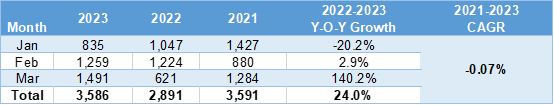

As an important material for shoes and textiles, monomeric MDI (MMDI) has also been affected. Polyurethane has excellent physical properties and chemical stability, so it is widely used in fields such as shoes, furniture, automobiles, construction, and garment. Due to shrinking exports and reduced orders, Vietnamese shoe manufacturers are also suffering production pressure and intensified market competition. Additionally, Vietnam does not have companies or the capacity to produce MMDI, so it mainly relies on imports from countries such as China, Japan, and South Korea. In March 2023, Vietnam’s textile and apparel exports reached roughly USD 3.298 billion, with a month-on-month increase of 18.11% but a year-on-year decrease of 12.91%, according to VITAS. In terms of MMDI exported from China to Vietnam, although Vietnam’s MMDI consumption in Q1 of 2023 showed a significant increase compared to 2022, with a year-on-year growth rate of 24%, it still had a negative compound annual growth rate compared to 2021, indicating a decline in Vietnam’s MMDI consumption over the past two years.

Table 1: MMDI Exports from China to Vietnam in Q1 of 2021-2023(ton)

Data Source: Customs Data

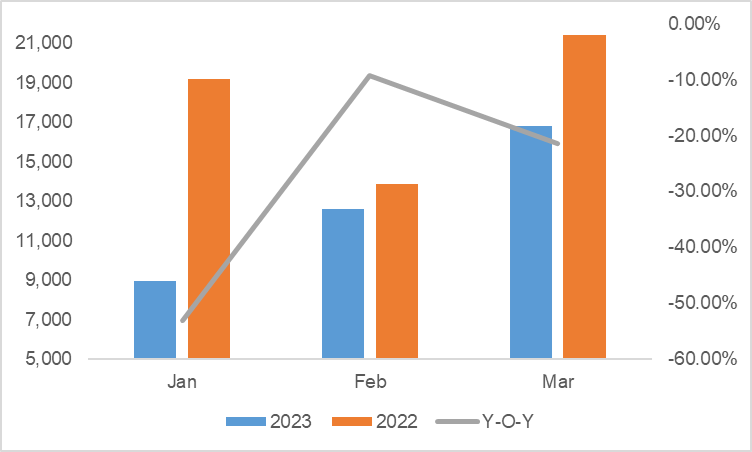

Moreover, Vietnam, one of the top four car producers in ASEAN, also saw a significant decline in its auto output in Q1 of 2023, with the total output from January to March down by 29.5% year-on-year. It is mainly due to the decrease in overseas orders and the shrinkage of foreign investment in Vietnam’s automobile industry.

Figure 1: Vietnam’s Auto Outputs & YoY Changes in Q1 of 2022-2023

Data Source: ASEAN Automotive Federation

The World Bank stated in an earlier report that economies like Vietnam, which rely on commodities and exports, are particularly vulnerable to the impact of slowing export demand. In the second half of 2023, it is expected that the Vietnamese textile, garment, and footwear markets will have the opportunity to revive in July and August this year as the country’s economy gradually rebounds. However, the local automobile industry may not be able to regain its previous momentum owing to Vietnam’s focus on light industries, with its automobile industry far behind larger countries such as Thailand and Indonesia.