The Middle East has a fast-growing population with a high youth rate and strong purchasing power, so that the region has a great potential for car consumption. However, the automobile industry in the Middle East mainly relies on imports from China, Japan, Europe, the U.S., South Korea and other countries. Currently, Iranian automobile Industry is the most developed in the Middle East, with growing production of automobile components and consumer demand in recent years. As a major auto producer in West Asia and the Gulf region, Iran has a relatively complete automobile industry chain and some established automakers. The major automakers include IKCO, SAIPA, Pars Khodro, Kerman, and Bahman, and the main car models are Samand, Tiba, Dena, etc. IKCO and SAIPA are the two major automakers in Iran. At the end of 2022, there were even reports that Iran will export cars to Russia, with IKCO providing car models for the Russian market. IKCO’s overall strength is second only to the National Iranian Oil Company.

Iran produced around 1.348 million vehicles (including heavy-duty, commercial, and passenger cars) in 2022-23 fiscal year (ending on March 21), an increase of 40% over the previous year, according to Ministry of Industry, Mine and Trade of Iran. The total vehicle production of the two largest automakers, SAIPA and IKCO, reached 961,000, a year-on-year increase of 479%. In the first month of the 2023-24 fiscal year (March 21-April 20), SAIPA’s monthly auto production reached 29,391, a year-on-year increase of 41%. In the first two months of the 2023-24 fiscal year (March 21- May 21), Iranian auto production (including commercial and passenger cars) amounted to 193,437, a year-on-year increase of 48%. Among them, passenger car production reached 165,874, a year-on-year increase of 45%; pickup truck production reached 21,404, a year-on-year increase of 58%; and truck production reached 713, an increase of 1,108% compared to the same period of the previous fiscal year.

Among oil producers in the Middle East, the UAE plans to launch a car manufacturing program in 2025; Saudi Arabia is ambitious to invest billions of dollars to create an electric vehicle manufacturing hub, with the goal of producing 500,000 vehicles annually by 2030. The Middle East is still a fully competitive market. Although different car brands, models, and displacements are subject to the same tax and fee policies, Japanese and Korean brands have been deeply rooted in the Middle East market for many years. Therefore, given consumers’ requirements for high-quality cars, Chinese automakers still need to make great efforts to accelerate their layout in the Middle East.

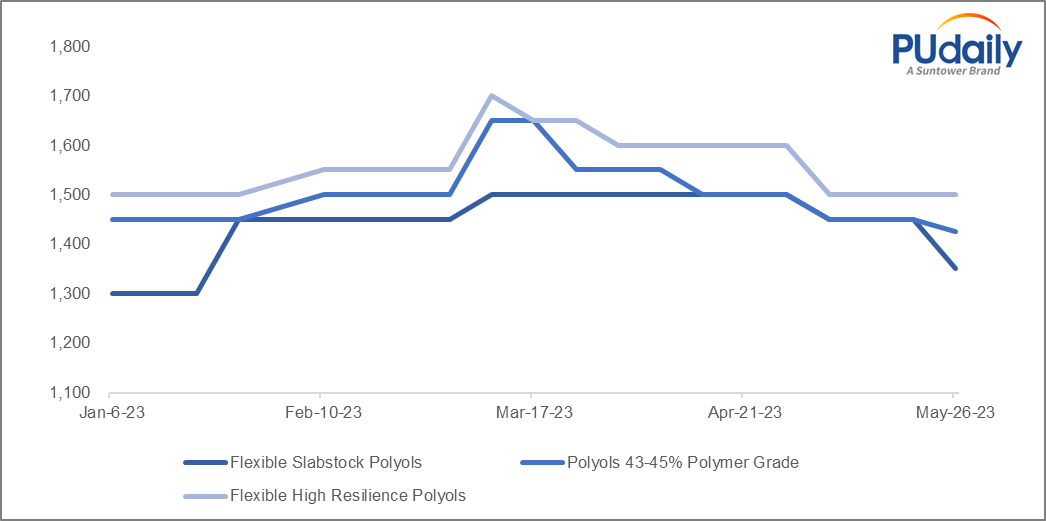

Price Trend of Polyether Polyols in the Middle East in 2023 (USD/tonne)

As an important raw material for car seat backs, the demand for polyether polyol will be boosted by the continuous development of the automobile industry in the Middle East. According to PUdaily, polyether polyol suppliers in the Middle East are mainly concentrated in Saudi Arabia, such as Sadara and Huntsman APC. Sadara has an annual capacity of 400 ktpa of polyether polyols, and Huntsman APC has a capacity of 20 ktpa. In addition to supplying the domestic market, the polyether polyol producers in Saudi Arabia also regularly export their goods to the Gulf and other Middle Eastern countries. Saudi Arabia is also one of China’s main import sources of polyether polyols. From January to April 2023, China imported 25,582 tonnes of other polyether polyols in primary forms from Saudi Arabia, second only to Singapore, according to customs data. China also exports polyether polyols to Middle Eastern countries such as Turkey, the UAE, Egypt, and Saudi Arabia. The total export volume to Middle Eastern countries from January to April 2023 was as high as 168,113 tonnes. PUdaily also track the market prices of flexible slabstock polyols, polymer polyols (slabstock), and flexible high resilience polyols in the Middle East on a weekly basis. The complete weekly report has already been launched. If you are interested in the Middle Eastern market, you can subscribe to our weekly report for further information.