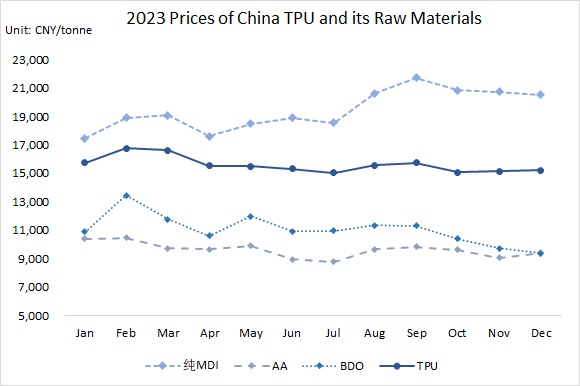

In 2023, China’s TPU market showed range-bound fluctuations and remained generally subdued, with the highest prices occurring in February at the beginning of the year. In comparison to the slow decline throughout 2022, TPU prices hit bottom and rebounded in 2023, albeit with a limited recovery, keeping the year-long price curve still at a low level. However, in terms of demand, major suppliers this year turned their attention to high-end downstream sectors represented by car paint protection film, injecting new vitality into the growth of TPU consumption.

TPU Car Paint Protection Film: China’s High-End Manufacturing

TPU film is a thin film made from thermoplastic polyurethane and is a new type of high-performance eco-friendly film materials. Currently, the sports footwear and apparel sector remains the most significant application scenario for TPU films in China, especially with the use of semi-transparent films in outdoor footwear and apparel, which has maintained a stable growth rate of around 10-12% in recent years, with the utilization rate of breathable films also consistently exceeding 80%.

High-end TPU films are mainly used in military, healthcare, car paint protection, and other fields. Despite the current small usage, with the development of auto detailing and maintenance services, the continuous growth of car population, and the increase in disposable income per capita, TPU car paint protection films, with their excellent performance, have gradually catched favor of extensive consumers. Consequently, it has become an important product for TPU suppliers to focus on in research and development. Due to the stringent casting process of film base, the production of invisible TPU paint protection films have long been monopolized by major players. But now, with technological breakthroughs and innovations, Chinese companies are also promoting the application of TPU in car paint protection films, and aliphatic polycarbonate-based TPU has gradually occupied this market.

China’s retail sales of passenger cars in a narrow sense in 2023 is estimated to reach 25 million units. The installation rate of TPU car paint protection films is expected to be ***% in 2023. Therefore, based on a normal value of TPU paint protection film for a car at CNY ***, it’s forecasted that Chinese TPU paint protection film market will be valued at CNY *** billion. The weight of the car film varies due to factors such as material, thickness, and manufacturing process. The average weight of TPU paint protection film for each passenger car is around *** kg. Thus, China’s TPU car paint protection film market size in 2023 is projected to be *** thousand tonnes.

Movement of TPU Prices in China

Chinese TPU market has been relatively sluggish throughout the year, with a persistent trend of being more prone to decline than to rise. Pervasive pessimistic expectations led downstream buyers to be very cautious in their purchases, mainly focusing on essential needs. Prices remained at a low level throughout the year. The sellers expressed willingness to hold prices, but global economic contraction suppressed the market, forcing them to mostly sell at prevailing market prices. The industrial operating rate saw a slight increase compared to last year, showing an overall trend of bottoming out and rebounding.

China’s TPU Capacity & Output

Thanks to growing demand, Chinese TPU production capacity has continuously expanded over the past five years, with numerous enterprises investing in and constructing new production lines to meet the domestic and international demand for TPU materials. From 2019 to 2023, China’s TPU production capacity grew at a compound annual growth rate (CAGR) of 14.8%. In 2023, with the completion of Miracll Chemicals’ 200 ktpa TPU and 8 ktpa E-TPU project, as well as the new capacity and production line expansion by companies such as BASF and Covestro, the total TPU capacity in China reached 1.577 mtpa, a year-on-year increase of 22.1%.

Driven by demand, China has also witnessed a gradual increase inTPU output year by year. From 2019 to 2023, China’s TPU output grew at a CAGR of 7.7%, with a total output of 707,000 tonnes in 2023, representing a year-on-year increase of 7.7%.

TPU Consumption in China

From 2019 to 2023, China’s TPU consumption achieved a CAGR of ***%. In 2023, the total consumption is around *** thousand tonnes, reversing the previous year’s decline and demonstrating a strong year-on-year growth of ***%.

The strong growth is primarily attributed to Chinese economic recovery, which has spurred growth in the chemical market. Tax incentives and technological upgrades have injected vitality into the industry, while ongoing industry consolidation has enhanced the competitiveness of TPU suppliers. The continuously growing demand in emerging markets, particularly in areas such as automotive applications, has been driven by advancements in product performance. Meanwhile, the appreciation of the Renminbi and the resurgence of international trade have steadily increased demand for TPU in overseas markets as well.

If you are interested in Chinese polyurethane elastomers market trend and the development of TPU based car paint protective film in 2023, feel free to inquire about and subscribe to China Polyurethane Elastomers (including TPU & CPU) Market Research Report 2023, published by PUdaily.