On January 16, Shandong Longhua New Material Co., Ltd released its 2023 earnings preannouncement. Net profits attributable to shareholders of the listed company are estimated to be around CNY 225-260 million, an increase of 77.19% to 104.75% year-on-year; and net profits after deducting non-recurring gains and losses are estimated to be about CNY 218-253 million, an increase of 95.66% to 127.08% year-on-year. In 2023, Longhua New Material’s 360ktpa high-performance polyether polyol expansion project was put into use. The company’s sale volume of polyether polyols reached about 541,600 tonnes, up 82.91% year-on-year, of which 60% is polymer polyol (POP).

POP is Longhua New Material’s flagship product, serving as a leading product in Shandong Province’s manufacturing industry. POP, in form of milky white viscous liquid, is commonly referred to as “white oil”. It is formally known as ethylene polymer-grafted polyether polyol, a modified polyether with special properties. It is obtained through the copolymerization of general flexible slabstock polyols with styrene and acrylonitrile, constituting a blend of ethylene monomers.

Longhua’s POP products, such as LHS-50, LHS-100, LHS-200, LHH-500L, LPOP-36/30, demonstrate strong competitiveness in the mid-to-high-end polyether market. Technical parameters such as solid content, viscosity, gelation in water, residual monomer concentration, color, and moisture are commonly used to gauge the performance of POP in downstream applications. Longhua New Material employs self-developed POP production technology that eliminates the need for chain transfer agents, resulting in good product stability, low monomer content, stable, safe and green reactions, increasing production capacity, and effectively reducing the odor and viscosity of POP.

The raw materials for polyether polyol are all derived from petrochemical industry. Polyether polyol prices are greatly influenced by fluctuations in oil prices, which directly or indirectly affect polyether polyol producers’ procurement costs through its impact on the market prices of ethylene oxide, propylene oxide, styrene, and acrylonitrile. As the majority of Chinese polyols producers lack supporting upstream facilities, they are particularly susceptible to constraints regarding raw materials. The profit margin of the industry is largely determined by technological element and additional value in the products, and is also influenced by factors such as fluctuations in raw material prices. In the polyols industry, there are significant differences in profitability among producers due to variations in scale, cost, technology, product structure, and management.

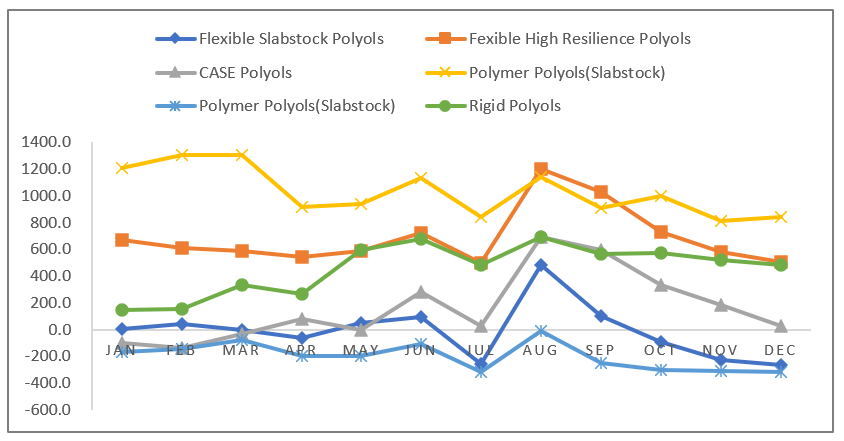

In 2023, POP (slabstock) was the most profitable, with a gross profit margin of 9.9%; followed by 330N high resilience, with a gross profit margin of 7.4%; and then rigid polyols 4110, with nearly a 5% gross profit margin; CASE polyols maintained thin margins. Different polyols have varying consumption levels of ethylene oxide, propylene oxide, propylene glycol, acrylonitrile, and styrene. Flexible slabstock polyols and high-activity POP were in a loss-making state throughout the year due to downward raw material prices and price competition.

Average Monthly Profits of Various Polyether Polyols in 2023 (CNY/tonne)

Note: CASE polyols refer to 220; Flexible High Resilience Polyols refer to 330N; Flexible Slabstock Polyols refer to MW3000; Polymer Polyols (Slabstock) refer to 2045; Polymer Polyols (High Resilience) refer to 3028;Rigid polyols refer to 4110.

If you are interested in supply, comsumption, price, profit, forecast of polyether polyols in the Asia-Pacific region and other related information, feel free to inquire and subscribe to Asia Pacific Polyether Polyols Market Report 2023, published by Pudaily, via Tel: 86-21-61250980 and E-mail: marketing@pudaily.com.