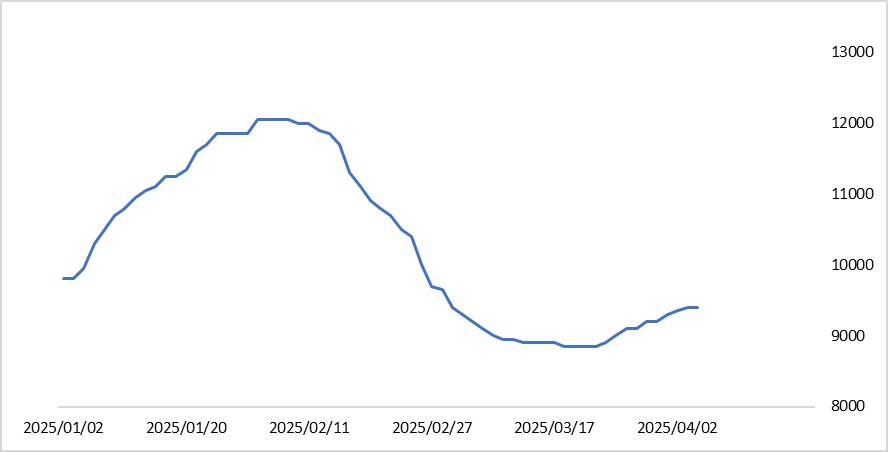

Chinese acrylonitrile market experienced a roller-coaster ride in the first quarter of 2025. The significant price fluctuations were primarily attributed to supply changes and demand uncertainty.

China Acrylonitrile Prices in Q1 2025

In January, the industrial operating rate of acrylonitrile decreased due to maintenance activities in ZPC and facility shutdown at Lihuayi Weiyuan Chemical. Tightening supply somewhat boosted the market. Between January to early February, acrylonitrile prices surged by CNY 2,000/tonne. But later, acrylonitrile supply increased as some suppliers raised their operating rates. Demand turned weaker with slow resumption of work by downstream manufacturers after Chinese Spring Festival. The upward momentum driven by the tightening supply was destroyed. Subsequently, Lihuayi Weiyuan Chemical restarted its acrylonitrile facility, and some other suppliers slightly increased production. The higher capacity utilization rate significantly increased goods available on the market. As a result, acrylonitrile prices swung sharply. As of late February, prices had nearly returned to the levels seen during the New Year period, with those in East China standing around CNY 9,600-9,800/tonne.

The market gradually stabilized in mid-March. As sellers maintained their sales efforts and buyers adopted a cautious approach, the prices for acrylonitrile moved sideways within the range of CNY 8,800-9,000/tonne.

In early April, some facilities at Sinopec Anqing are shut down for maintenance, and certain facilities are operating at lower capacity utilization rates. Several suppliers plan to undergo maintenance in May. These production adjustments indicate a slight tightening in acrylonitrile supply, which has contributed to a rebound in prices. However, downstream manufacturers keep just-in-time purchasing. Acrylonitrile prices in China are predicted to move around CNY 9,000-9,500/tonne in April.