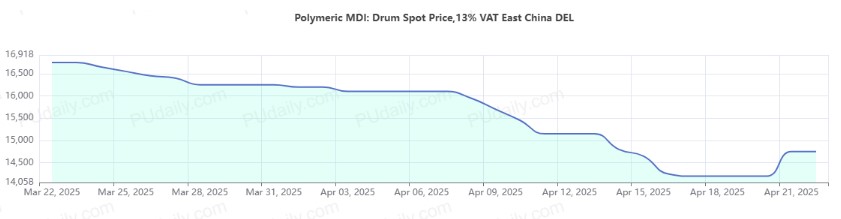

Chinese PMDI market witnessed a rebound on April 21. The mainstream offers in East China bounced back to CNY 14,500-15,000/tonne, an increase of CNY 500-600/tonne from that of last Friday (April 18). This is the first rebound since mid-February this year, when bearish news had frequently hit the market.

Escalating Trade Tensions Remain the Recent Largest Headwind!

- In mid-February, the U.S. initiated an anti-dumping investigation of MDI from China.

- On March 4, the U.S. imposed an additional 20% tariff on all Chinese products.

- On March 28, the U.S. International Trade Commission (USITC) determined to continue its investigations of MDI from China.

- On April 3, the U.S. announced to impose reciprocal tariffs on multiple countries, including China, which severely hurt profitability of manufacturers in many countries.

Chinese PMDI market has been undergoing a difficult time over the past months.

In the first week of April, China’s PMDI market experienced a significant decline. After the U.S. announcement of new tariffs, global market participants generally took a risk-averse behavior, causing oil prices to plunge and financial markets to see heightened volatility. Prices for benzene and aniline subsequently fell, leading to a significant reduction in material costs.

Meanwhile, the market lacked supports from both supply and demand sides. In terms of supply, most suppliers maintained stable operating rates except for some which had already been under maintenance. In terms of demand, many downstream manufacturers in the construction sector took a cautious approach in material procurement due to uncertainty in their orders in future, although they were not directly affected by tariffs issues. The triple negative factors of cost, supply and demand triggered rising bearishness among traders and intensified their selling pressure, resulting in a sharp decline in PMDI prices in the first half of April.

In the second week of April, China’s PMDI market plunged and then rebounded. On April 14, the market experienced a sharp decline. On April 15, Wanhua announced trading halt. The market remained weak though the decline slowed. The postponed restart of an MDI facility in Ningbo provided a certain boost to the market midweek. As prices fell below CNY 14,000/tonne and some downstream manufacturers began pre-holiday restocking, inquiries and purchases increased. The market sentiment gradually recovered. On the afternoon of April 18, the market activities increased and the actual deal prices (for 44V20, M20S and 5005) rebounded to CNY 14,000-14,200/tonne. Some traders turned to withhold sell at low prices.

Was Market Panic Excessive? Bearish News Has Gradually Been Absorbed.

On April 20, China’s Customs released the latestly export data that PMDI exports to the U.S. in this March totaled 9,238 tonnes, down about 2,000 tonnes from the prior month. But the U.S. has remained China’s PMDI dominant export destination. Due to rising import costs, PMDI market (formula prices, drums) in the U.S. have been rising from $2,200-2,300/tonne at the beginning of the year to the current level of $2,400-2,450/tonne, representing an increase of 6.5-9.0%.

The PMDI Market is Expected to Keep Rising as the Ongoing Downtrend in Crude Oil Prices has been Disrupted.

Despite uncertainties in global trade policies, their impact on market sentiment appears to have weakened marginally. By April 18, the ongoing downtrend in crude oil prices was disrupted. Two bullish signs emerged in the crude oil market: First, Brent crude oil prices climbed above the upper boundary of its prior horizontal trading range, breaking the lateral movement rhythm; second, Brent crude oil prices rose above the 5-day and 10-day moving averages, with the 5-day MA crossing above the 10-day MA, indicating that the downward momentum has mostly evaporated. The market focus will shift from “downward pressure” to “new corrections” in the near term.

Chinese PMDI market is gradually recovering from its most recent bear market, which was spurred by multiple negative factors. Huntsman has already confirmed plans to advance shutdown maintenance at its Shanghai plant to May, and other MDI suppliers in East China will also start maintenance next month. Chinese PMDI market is expected to keep improvement.