China exported a total of 9.975 million foam mattresses during January to April 2025, down 2.5% year-on-year. The export value was USD 236 million, a decrease of 3.2% compared to the same period last year, according to customs data. The declines in the two key indicators were both below 3%, demonstrating the industry’s resilience amid rising uncertainties. The total weight of mattresses exported from China during this period reached 47,900 tonnes, up 2.1% year-on-year, reflecting a slight adjustment in product structure and an overall stable demand.

| Foam Mattress Exports(Under HS Code 94042100) | Quantity (1,000 pieces) | Weight (1,000 tonnes) | Value (USD 100 million) |

| Jan-Apr 2025 | 9,974.80 | 47.9 | 2.36 |

| Jan-Apr 2024 | 10,226.30 | 46.9 | 2.44 |

| YoY Change | -2.50% | 2.10% | -3.20% |

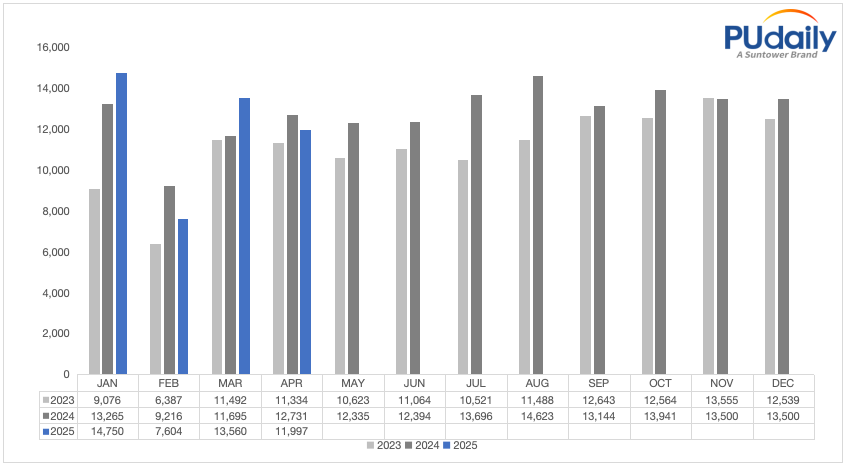

China’s Monthly Foam Mattress Exports 2023-2025 (tonne)

From January to April, Japan was the first export destination for Chinese foam mattresses, with exports totaling 7,881 tonnes, up 5.2% year-on-year, accounting for 16.4% of China’s total exports.

Table 1: Top 15 Export Destinations for China’s Foam Mattresses (Jan-Apr 2025)

|

Destination |

Weight (tonnes) |

Share (%) |

|

Japan |

7,881 |

16.44% |

|

USA |

7,146 |

14.91% |

|

Germany |

3,974 |

8.29% |

|

Mexico |

3,461 |

7.22% |

|

Australia |

3,219 |

6.71% |

|

France |

2,516 |

5.25% |

|

UK |

2,037 |

4.25% |

|

South Korea |

1,827 |

3.81% |

|

Thailand |

1,103 |

2.30% |

|

Poland |

1,083 |

2.26% |

|

Others |

13,693 |

28.56% |

|

Total |

47,940 |

100.00% |

Among these export destinations, traditional markets such as Japan, the USA and Germany made up 44.55% of the total exports (with the top three destinations combined to occupy 39.64% of the market share). Exports to Japan increased by 5.2% year-on-year to 7,881 tonnes, highlighting strong resilience in key markets. Although some market shares fluctuated slightly, the top 15 destinations accounted for over 70% of exports, indicating a stable market landscape and endorsing the robust demand for Chinese mattress products in the international market.

It indicates that China’s mattress industry could hold on in the face of an ever-changing global environment. Chinese manufacturers have made risk mitigation efforts to counter external uncertainties, such as retaining existing customer bases and optimizing product structure. The slight changes in export volume and value mostly reflect normal market fluctuations rather than a shift in demand trends. The fundamentals remain stable and strong.

Going forward, China’s mattress exports are expected to keep resilient amid stable recovery in global consumer demand. Chinese businesses should continue to focus on market needs and optimize supply chain, steadily increasing added value while maintaining cost advantages, thereby further enhancing market share and promoting sustainable industrial development.