China’s TDI market has surged in July due to an array of positive news:

- On July 9, Covestro Shanghai raised its TDI guide price to CNY 12,700/tonne in bulk;

- On July 9, Wanhua Chemical stopped taking orders in Southeast Asia due to excessive demand and planned to raise its July TDI price by USD 100/tonne;

- On July 10, Covestro Shanghai announced suspension of TDI trading;

- On July 11, Wanhua Chemical increased its mid-July price for TDI by CNY 1,000/tonne to CNY 13,500/tonne;

- On July 12, a fire broke out at an external transformer station in building L26 at Chempark Dormagen. On July 16, Covestro declared force majeure on TDI;

- On July 14, Covestro Shanghai raised its TDI price to CNY 13,200/tonne;

- On July 14, Covestro Shanghai again halted TDI trading;

- On July 16, Covestro Shanghai further raised the TDI price to CNY 14,200/tonne;

- On July 17, Wanhua Chemical stopped taking orders from distributors for TDI;

- On July 17, BorsodChem increased TDI price by EUR 500/tonne;

- On July 18, Wanhua Chemical raised the July TDI price for direct sales by CNY 4,500/tonne to CNY 18,500/tonne;

- On July 18, Covestro Shanghai raised the TDI price to CNY 17,100/tonne.

Meanwhile, multiple TDI facilities are under maintenance. Wanhua Chemical’s Phase I TDI facility in Fujian has been shut down for maintenance since June 5. This maintenance, expected to span 45 days, has yet to come to an end. Xinjiang Heshan Juli’s TDI facility started maintenance on July 15 and is expected to last 33 days. Gansu Yinguang’s TDI facility is scheduled to undergo maintenance at the end of July for 7-15 days. BorsodChem’s 250 ktpa TDI facility began routine maintenance on July 19, which was scheduled for four weeks.

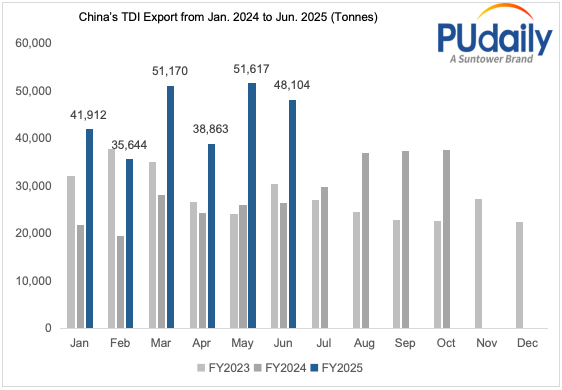

China’s TDI exports continued to see better-than-expected performance.

China exported 48,000 tonnes of TDI in June 2025, a year-on-year increase of 81.6%. China’s TDI exports from January to June 2025 amounted to 267,000 tonnes, up 82.9% year-on-year. The total annual export volume is expected to exceed 400,000 tonnes, reaching a record high.

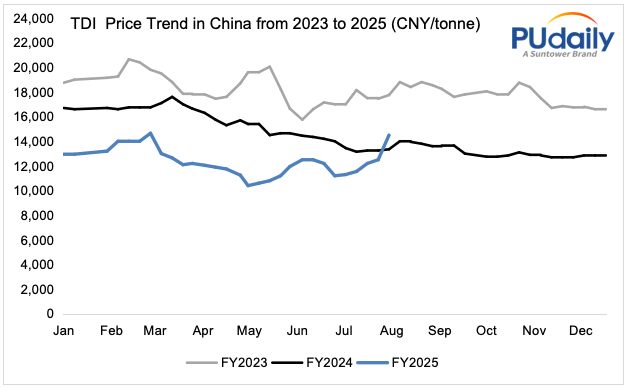

Buoyed by multiple bullish factors, traders have mostly halted trading or maintained high prices starting mid-July. As of July 18, TDI prices in China had risen sharply to around CNY 15,000/tonne, up nearly CNY 2,500/tonne month on month, representing a weekly increase of nearly 20%. Some traders even quoted prices as high as CNY 17,000/tonne or above.

Actually, the current TDI price is still at historically low levels and just surpassing the producers’ break-even point. Although TDI prices have seen significant increases recently, there remains some upward momentum due to supply reductions and robust export demand. Moving forward, as some facilities resume production after maintenance, TDI supply will fluctuate and price trends will be impacted. If facilities are restarted as scheduled and production levels return to normal, increased supply may slow the price rise or even lead to a correction. If restarts are delayed or production falls short of expectations, it can lead to further price hikes due to ongoing supply tightness.

Given these unpredictable dynamics, access to accurate, real-time market intelligence has become essential. PUdaily’s Pricing Intelligence Service and dedicated Asia-Pacific TDI reports help industry participants anticipate shifts, benchmark prices, and make better-informed procurement and sales decisions amid the uncertainty.