On July 2, former U.S. President Donald Trump and his representatives announced via social media a new trade agreement with Vietnam. Under this deal, the United States will impose a 20% tariff on Vietnamese exports, while Vietnam has agreed to implement a 0% tariff on goods imported from the United States. A key element in this deal is the inclusion of a 40% tariff on transshipped goods, aimed at preventing the mislabelling of origin—particularly targeting products manufactured in China but rebranded as Vietnamese to avoid U.S. tariffs on Chinese goods. This move makes Vietnam the second Southeast Asian nation to finalise a trade deal with the United States in recent weeks.

One week later, on July 22, President Trump announced a similar trade deal with the Philippines. Under this agreement, exports from the Philippines to the United States will face a 19% tariff, 2% higher than what was proposed as “reciprocal” terms back in April, but 1% lower than the August threatened figures. In return, U.S. exports to the Philippines will be tariff-free.

During the same week, the White House disclosed details of another agreement with Indonesia. As with the Philippines, Indonesia’s exports to the United States will face a 19% tariff, while American goods exported to Indonesia will not be subject to any tariffs. However, the Indonesia deal is more commercially significant in scope, involving a $3.2 billion agreement for the purchase of American aircraft and a $15 billion commitment for U.S. energy products.

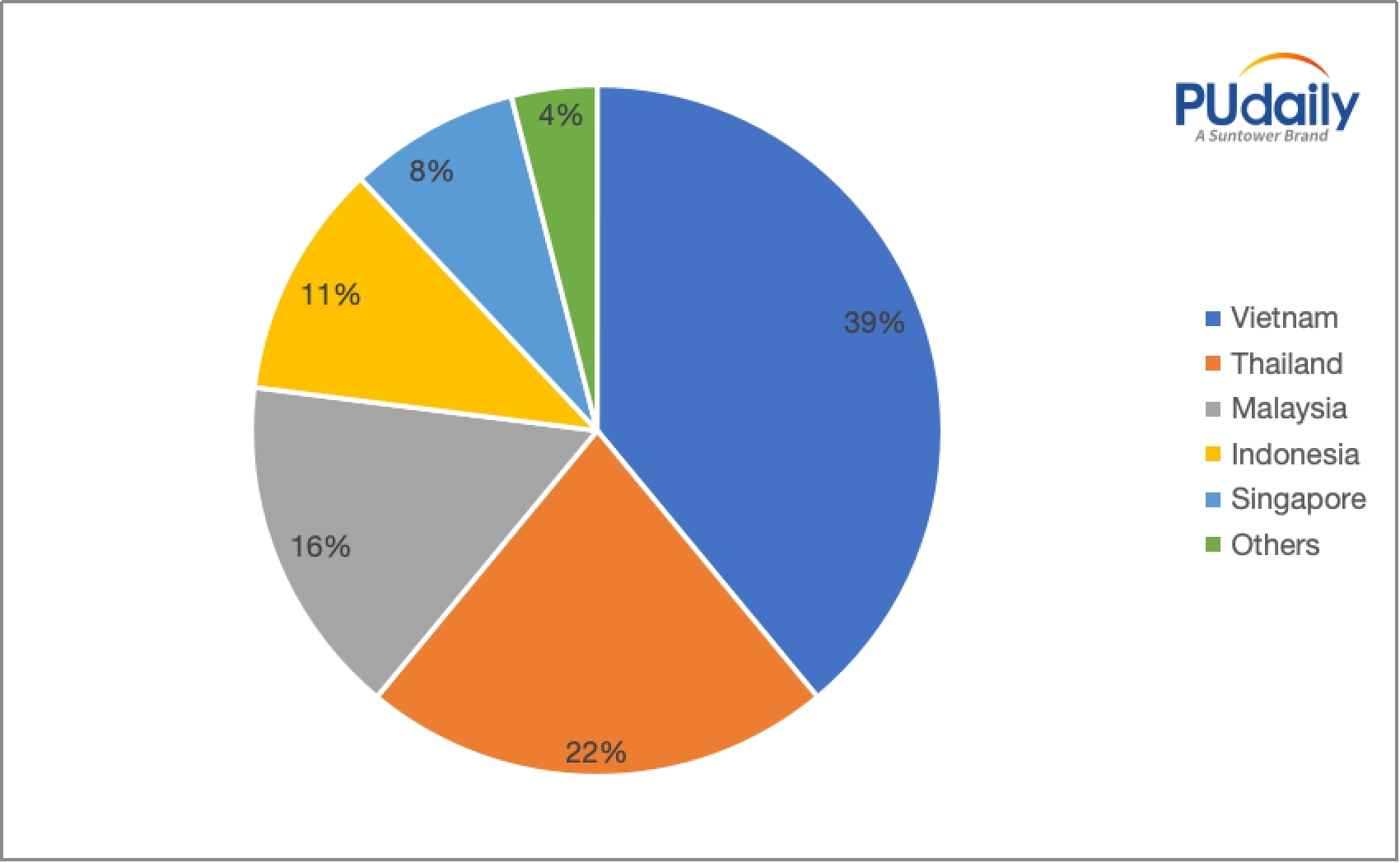

Southeast Asian Countries’ Shares of China, Japan and Korea’s MDI Exports in 2024 (%)

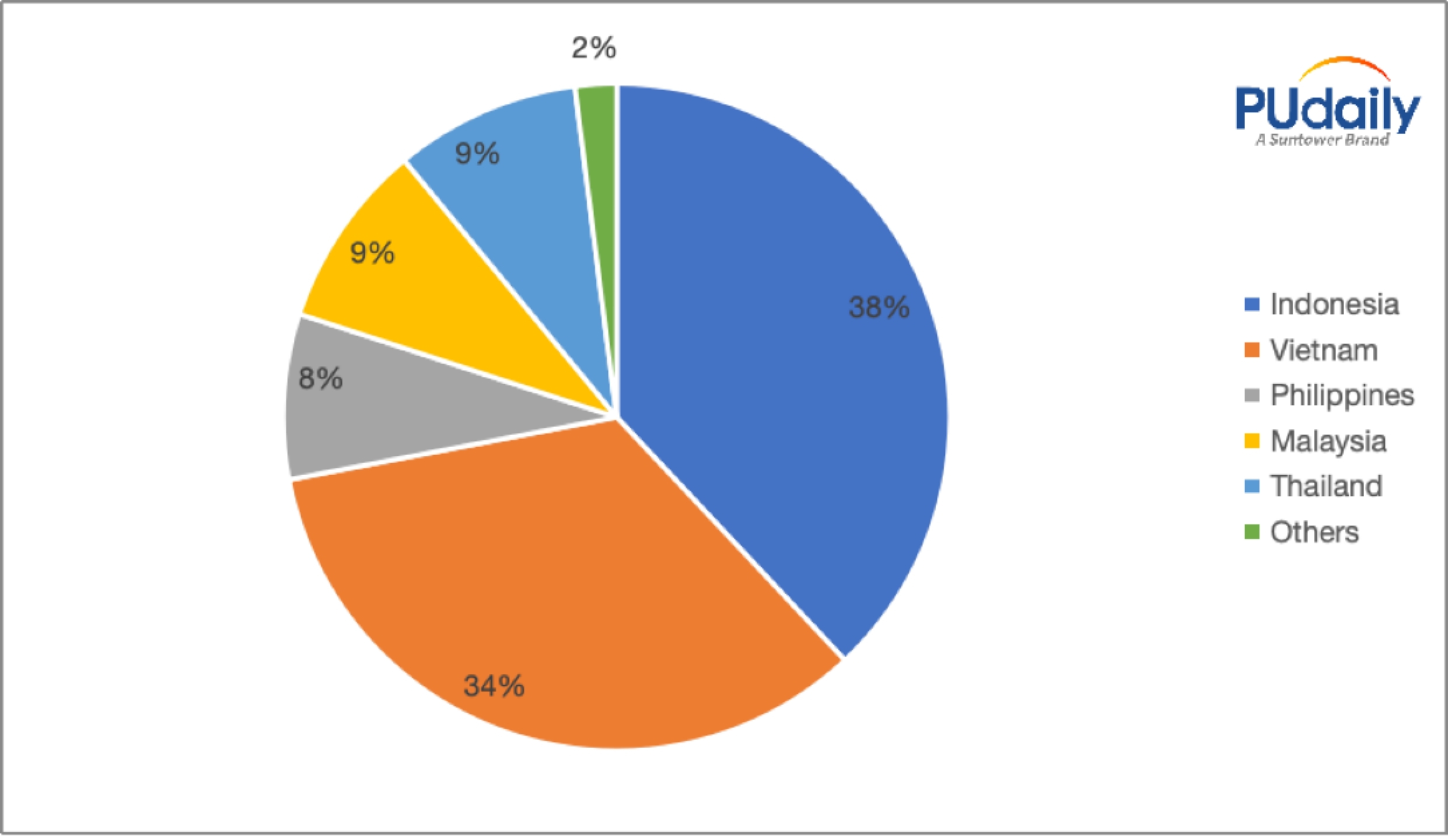

These recent trade deals present uncertainties for Southeast Asia’s polyurethane market. In 2024, Vietnam accounted for 39% of MDI (methylene diphenyl diisocyanate) and 34% of TDI (toluene diisocyanate) demand in the region, making it the largest MDI importer and second-largest TDI importer in Southeast Asia. Indonesia, meanwhile, was the largest TDI importer, representing 38% of the region’s imports, and also imported 11% of its MDI volume. These figures highlight just how integral both countries are to the regional polyurethane supply chain.

Southeast Asian Countries’ Shares of China, Japan and Korea’s TDI Exports in 2024 (%)

The new agreements offer opportunities to reduce costs for key downstream industries—such as footwear, home appliances, automotive interiors, and spandex—by allowing U.S. polyurethane-based products to enter Southeast Asian markets at lower or no tariffs. However, there are complications. Vietnam, in particular, may face major challenges depending on how the U.S. chooses to enforce the transshipment clause. Vietnam is the second-largest footwear exporter globally, after China, and heavily depends on MMDI imports from China, South Korea, and Japan. MMDI is essential for manufacturing TPU in footwear and spandex in sportswear and swimwear. But Vietnam has no domestic MDI production capacity, making it fully reliant on imports.

If the U.S. enforces the 40% transshipment levy strictly, Vietnamese firms that import MDI or MMDI from China for manufacturing may be subject to higher duties, potentially disrupting their supply chain. The transshipment clause, while designed to prevent circumvention of tariffs on Chinese goods, could significantly hurt Vietnam’s export industries if interpreted stringently.

Moreover, the Vietnam–U.S. trade deal could place further strain on Vietnam’s relationship with China. Beijing has already made clear that any trade agreements designed to side-line China’s role in global supply chains will be met with retaliation. This puts Hanoi in a strategic dilemma. Closer ties with the U.S. may allow for better market access and reduced input costs for certain goods. However, moving away from China could jeopardize access to essential raw materials like MDI, which are critical to the country’s manufacturing sector. Conversely, losing access to the U.S. market—particularly as the U.S. is the largest importer of Vietnamese footwear—would also have serious consequences.

The Philippines and Indonesia have also included transshipment clauses in their respective trade agreements, though the specific tariff rates have yet to be disclosed. Both countries remain heavily dependent on Chinese polyurethane imports, particularly Indonesia, where over 60% of its TDI imports this year have originated from China. This reliance leaves them exposed to the ripple effects of U.S.–China trade tensions, potentially placing them in a difficult position as they navigate between two major economic powers.

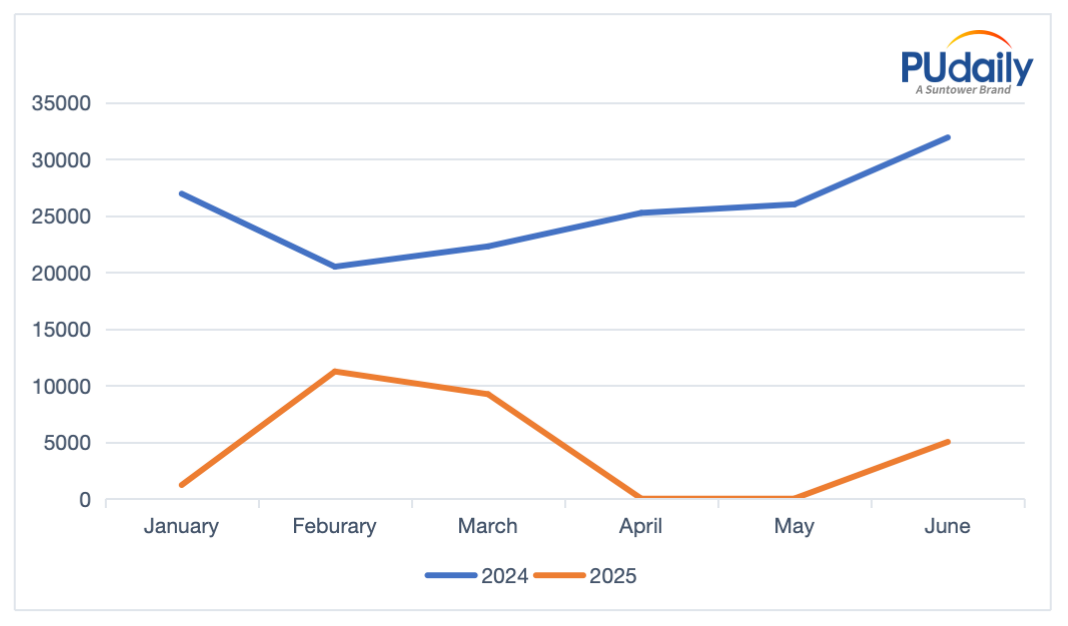

It is worth noting that amid ongoing trade negotiations between the United States and several Southeast Asian countries, China’s PMDI exports to the U.S. have shown signs of recovery. Although the announcement of reciprocal tariffs in April and May temporarily halted all PMDI shipments, exports resumed in June with approximately 5,000 tonnes delivered—indicating a potential rebound in polyurethane trade flows from China to the U.S. However, export volumes remain significantly lower compared to the first half of 2024. Given that the U.S. was the largest importer of Chinese PMDI last year, escalating geopolitical tensions have markedly disrupted the polyurethane trade relationship between the two countries.

Comparison of China’s PMDI Exports to the U.S: H1 2024 vs. H1 2025

In summary, the outcomes of these trade negotiations—set to conclude before the August 1 deadline—will have both direct and indirect effects on the Southeast Asian polyurethane market. On one hand, the removal of U.S. tariffs on downstream products may support growth in key sectors. On the other hand, stricter enforcement of transshipment rules and rising geopolitical pressure may create new challenges for countries heavily dependent on Chinese supply chains.

As the regional polyurethane industry closely watches the unfolding agreements, it must also prepare for a more complex and politically charged trading environment—where strategic decisions will be just as critical as commercial ones.

Given these unpredictable dynamics, access to accurate, real-time market intelligence has become essential. PUdaily’s Pricing Intelligence Service and dedicated Asia-Pacific TDI and Asia-Pacific MDI reports help industry participants anticipate shifts, benchmark prices, and make better-informed procurement and sales decisions amid the uncertainty.