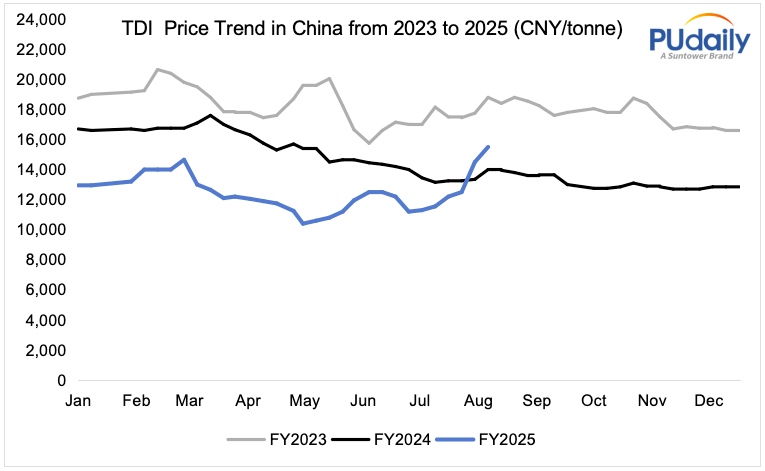

In July, the Chinese TDI market demonstrated robust upward momentum, with prices widening significantly. At the month's outset, the market extended late June's weak volatility, marked by subdued demand, sluggish new orders, and persistent sales pressure on traders, sustaining low price levels.

In early July, supported by suppliers' firming intentions, traders elevated offers, lifting the price center. Yet heightened downstream resistance capped high-price transactions, resulting in thin overall trading with sporadic inflated quotes. Later that week, mounting sales pressure prompted slight increases in low-price offers, leading to minor concessions in negotiations amid persistently tepid activity.

By mid-month, offers firmed slightly after Shanghai Covestro's guidance price hike, though downstream buyers remained hesitant on bulk orders, sustaining only rigid demand and limiting price gains. Early profit-taking emerged before news of a major Shandong producer raising Southeast Asia prices and operational issues at Fujian's new plant curtailed low-price offers, stabilizing quotations despite muted transactions.

In mid-to-late July, a fire at Covestro's European facilities triggered force majeure declarations, causing offers to surge dramatically as traders suspended sales. Subsequent developments—including Europe's 500 EUR/tonne TDI hike, Wanhua Chemical's prepayment price increase to 18,500 CNY/tonne, and Shanghai Covestro's fixed price at 17,100 CNY/tonne—intensified holding sentiment, with some quotes exceeding 15,000 CNY/tonne.

Approaching month-end, supplier-driven tailwinds initially pushed prices higher, creating a quote-rich but transaction-poor environment. Profit-taking soon emerged, and intensified selling pressure clarified transaction levels, triggering a sharp correction. Despite sparse new orders sustaining sales pressure, net weekly gains prevailed with most deals concentrated at lower levels.

Throughout the month, supply-side strength reversed the downtrend into rapid gains. Intensive positive news—including multiple plant outages exacerbating supply tightness—combined with suppliers' repeated price hikes and shipment reductions prompted traders to sharply lift offers. However, swift price advances met limited downstream follow-through, fracturing the market: some intermediaries suspended sales while others cashed out positions, occasionally releasing discounted cargoes. End-user resistance to high prices confined transactions to small rigid-demand orders before late-month supply tailwinds restored the firm trajectory after a brief correction.

China's TDI market is expected to maintain high-level consolidation in August. Current global production facility advantages persist, and despite restarts of some previously idled units, supply gaps remain. Coupled with producers' firm market support intentions and traders' cautious sentiment, offers are likely to follow factories' elevated pricing, maintaining strong domestic TDI prices. However, vigilance is required regarding demand suppression from high prices and potential corrections following further unit restarts. The market may follow a pattern of initial strength, subsequent softening, and eventual recovery, with close monitoring needed on global facility operations and producer policy guidance.

Given these unpredictable dynamics, access to accurate, real-time market intelligence has become essential. PUdaily’s Pricing Intelligence Service and dedicated Asia-Pacific TDI reports help industry participants anticipate shifts, benchmark prices, and make better-informed procurement and sales decisions amid the uncertainty.