The April–August 2025 U.S. tariff actions did more than raise rates, they injected day-to-day uncertainty into the polyurethane (PU) value chain. Producers of polyether polyols (PPG), systems houses, converters, distributors, OEMs, and even logistics and finance teams are now managing the same set of worries: what will the effective duty be on the next shipment, will it stack with something else, and will enforcement reinterpret origin after the fact? When duty outcomes can swing from 10% to roughly 50%, and, in a stress case, back above 100%,margins, inventory, lead times, and working capital move with them.

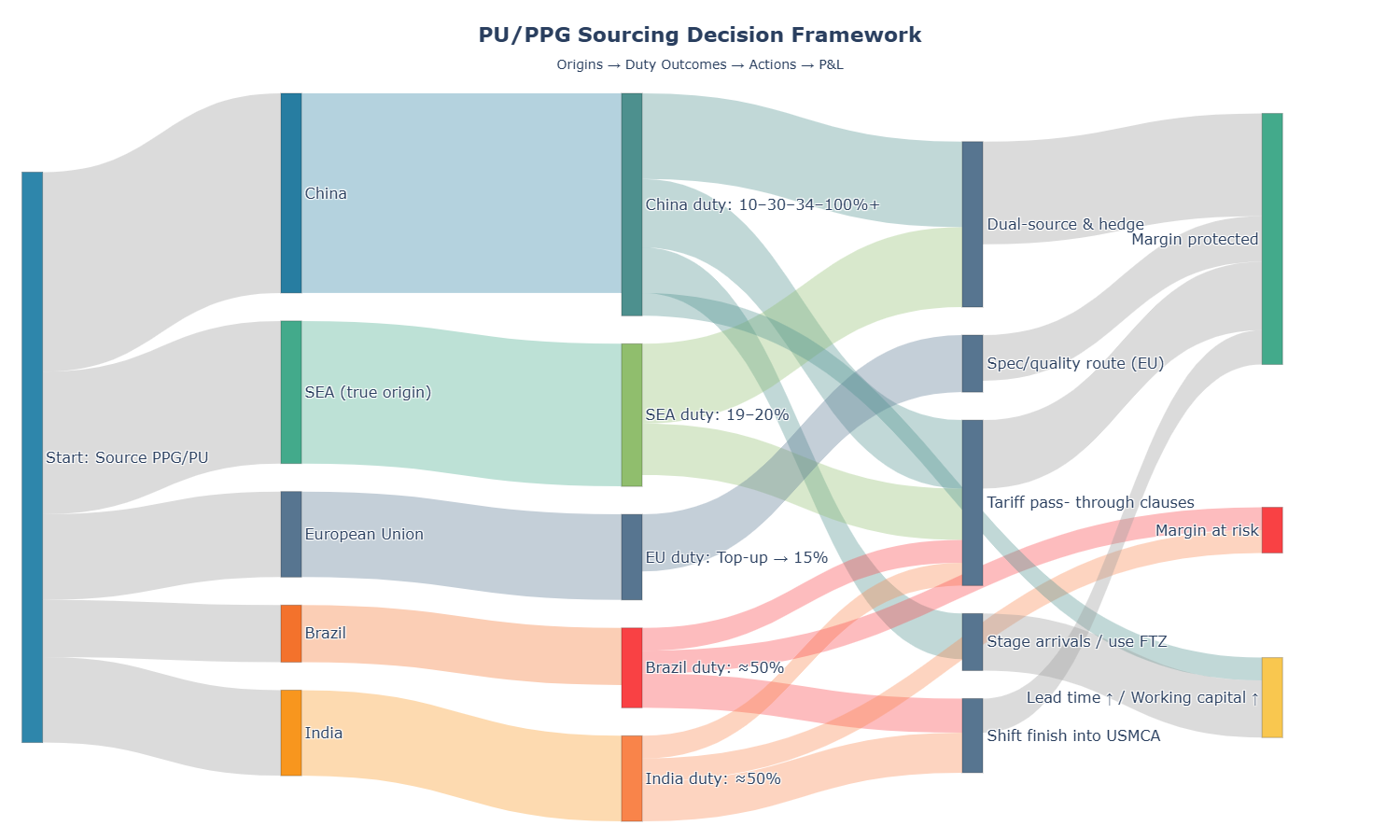

This analysis is designed for decision-makers on both sides of the trade, U.S. buyers and suppliers in Brazil, India, China, the EU, and Southeast Asia, who must plan under uncertainty. It establishes price baselines, explains (in plain language) how to calculate duties from real quotes, translates those calculations into P&L impact, and then outlines expected trade-share shifts and policy scenarios. The objective is not to predict politics, but to give the industry a workable playbook while policy remains in flux.

Policy recap

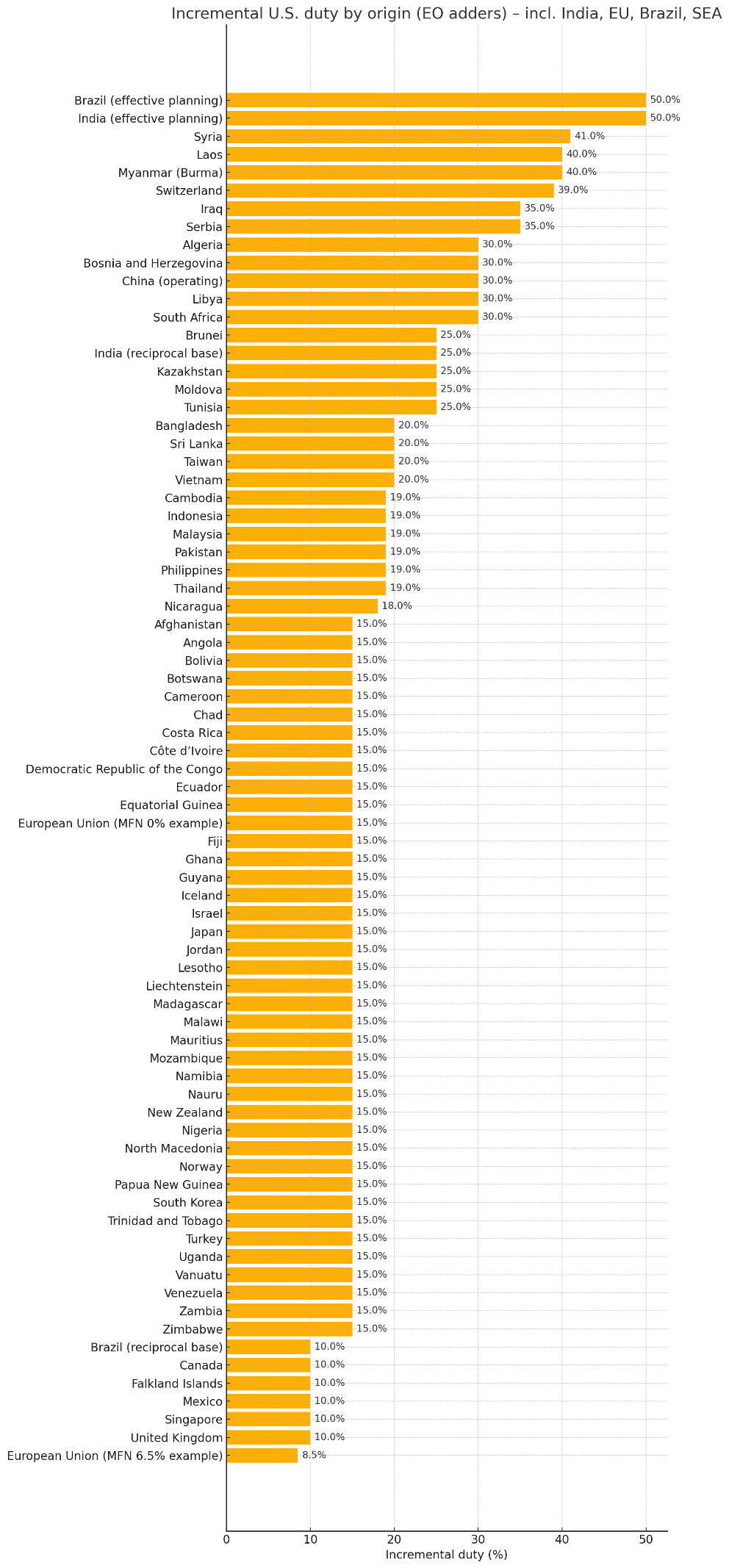

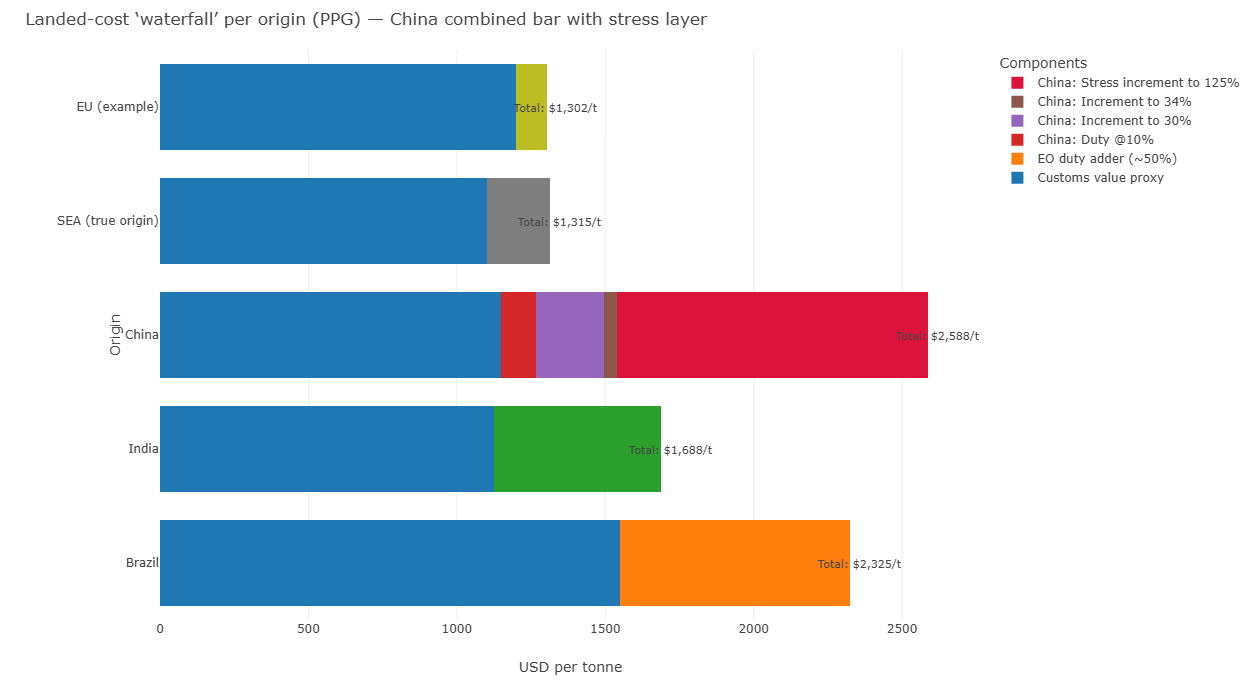

Four actions frame the new economics. First, the July 30 order on Brazil imposes an additional +40% on Brazil-origin imports (with broad Annex carve-outs for upstream commodities like ores, energy, pulp, and some metals; polyols/PU are not carved out). Stacking with the reciprocal regime is possible except where Section 232 applies. Second, the July 31 reciprocal re-set shifts to country-specific adders: for example, India +25%, Brazil +10%, and, importantly, for the EU an additional duty that tops the total rate up to 15% if the item’s MFN is below 15% (if MFN is 15% or higher, the additional duty is zero). The order also hardens anti-evasion: confirmed transshipment can draw an extra +40% penalty duty on top of applicable tariffs. Third, the August 6 order on India adds +25% on all India-origin imports owing to purchases of Russian oil, stacking with the reciprocal +25% to about 50%. Finally, China benefits from a suspension of higher China-specific surcharges, leaving +10% during negotiations; that suspension was extended on August 11 to November 10. Operations currently treat PRC imports at 30% for planning; scenario risk remains around that November decision point. However, based on negotiation outcomes tariffs can be lowered (at around 34% as some would suggest) , and 100–125% if negotiations break down and relations get sour ( as it was the case in the precedent months). All references to China duty in this report tie back to these four tiers.

Pricing baselines and calculation approach

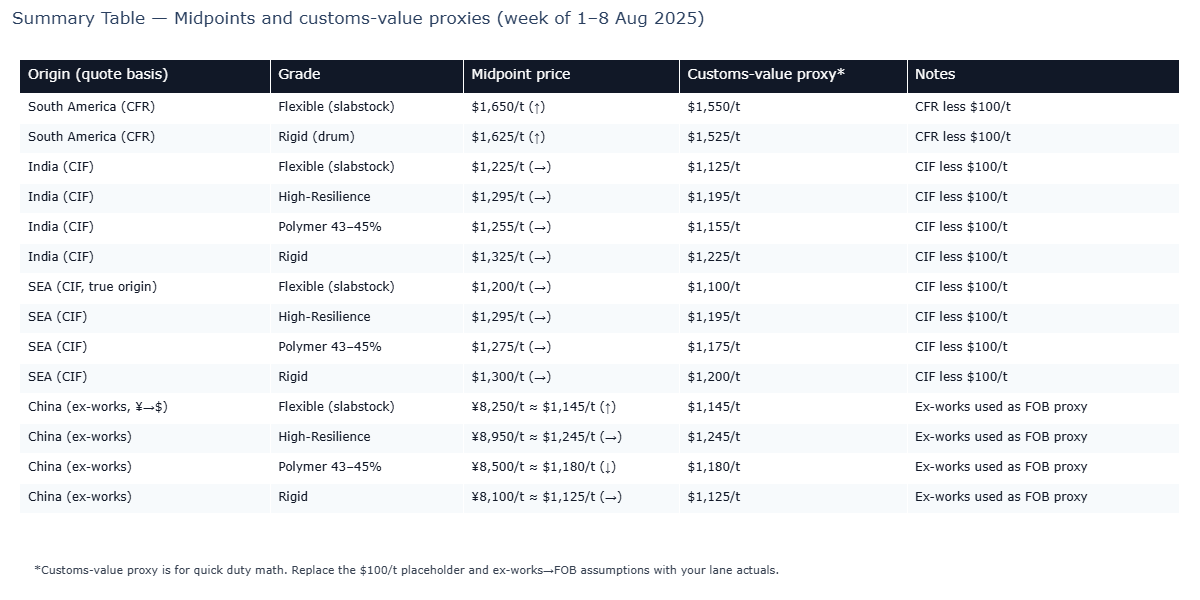

Market prices anchor the analysis, but duties are applied to the customs value (the dutiable base), not to the final delivered price. For CIF/CFR quotations (which include ocean freight and insurance), a practical way to approximate the customs value is to subtract a freight/insurance placeholder (here $100/t) until lane-exact data are loaded. For ex-works quotations (e.g., China), the customs value for U.S. duty purposes is typically close to the FOB/transaction value, which can be proxied by the ex-works price converted to USD ( in-country logistics to port may add modestly to FOB). Prices are from the week of 1–8 August 2025. For quick parity, ¥7.20 = $1.00 is used to convert China ex‑works to USD.

Two additional, market-shaping elements apply in South America. First, Brazil’s anti-dumping (AD) cash deposits on China-origin polyols, generally $1,408.70–$1,469.16/t (with one exporter around $959.19/t), lift import parity for PRC-origin polyols into Brazil. Second, Brazil’s AD duties on named U.S. producers (typically $555–$680/t) also support higher regional CFR quotes. These AD measures do not apply to U.S. imports; they matter because they keep South American regional prices structurally above India/SEA levels, shaping trade diversion and margin opportunities. We refer to this combined effect as the Brazil AD wall.

How U.S. duties are calculated

Working formula: Duty $/t = Customs value × (MFN + Additional EO + AD/CVD + Sec. 232)

In the exhibits that follow, we isolate the incremental EO layers so you can see the policy effect; MFN/AD/CVD/232 are noted separately.

*For CIF/CFR quotes we subtract a $100/t freight/insurance placeholder; replace with lane‑specific values to refine.

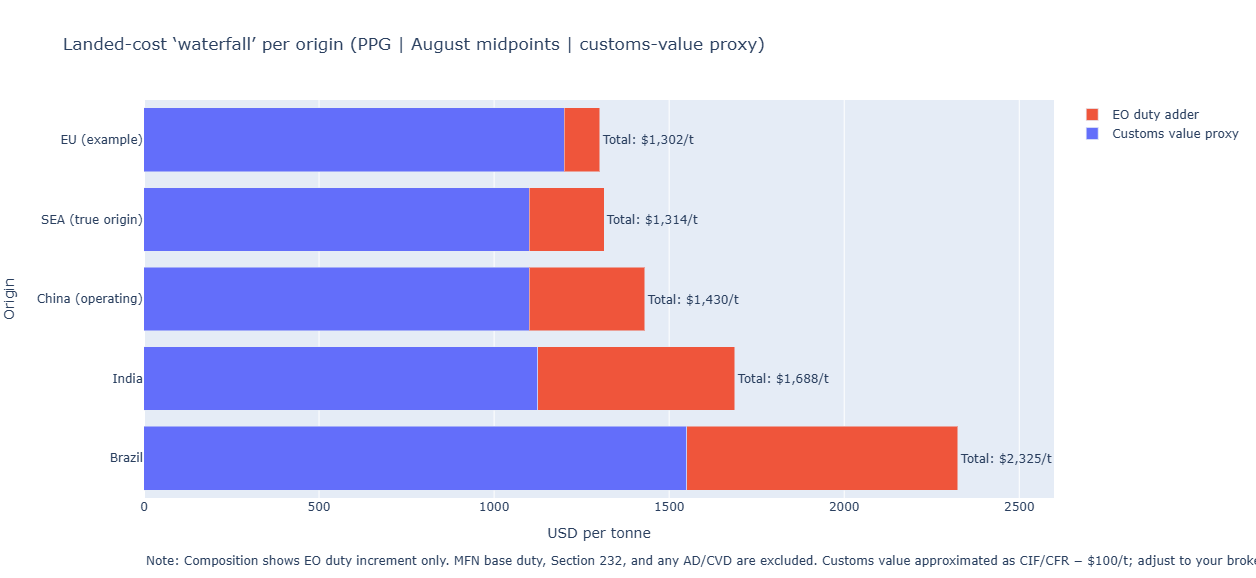

How the duty stack hits the landed cost

Landed cost for polyether polyols (PPG) and PU-related imports equals the commercial price plus logistics and all applicable duty layers. For duty math, the relevant base is the customs value. Because market quotes are typically CIF/CFR or ex‑works, this analysis uses a simple proxy: customs value = CIF/CFR minus $100/t to strip out an average freight/insurance placeholder. For China ex‑works quotes, we treat the midpoints as an FOB/CFR proxy for duty purposes. The incremental duties from the 2025 executive orders are then applied on top of any base MFN/AD/CVD/232 obligations. In short, Duty adder ($/t) = customs value × incremental ad‑valorem rate; total landed cost then adds port/terminal fees, brokerage, and inland freight after duties.

China (flexible slabstock polyol). A midpoint of ¥8,250/t converts to ≈ $1,145/t at ¥7.20/$ and serves as the customs base for scenarios. Depending on routing, the working customs‑value band is $1,050–$1,150/t. At the operating assumption of 30%, the duty adder is $315–$345/t. If talks hold and the 10% suspension persists, the adder drops to $105–$115/t. If policy tightens toward 34%, the adder rises to $357–$391/t.

India. For flexible slabstock, CIF $1,225/t yields a customs value of $1,125/t. With the stacked 50% (reciprocal +25% and the Russia‑oil +25%), the duty adder is ≈ $563/t.

Brazil. With CFR $1,650/t and a customs value of $1,550/t—and recognizing the effective 50% combined duty environment on most PU/PPG items, the adder is ≈ $775/t.

Southeast Asia (true origin). For CIF $1,200/t, the customs value is $1,100/t. At 19–20% incremental duties, the adder is $209–$220/t. Provided origin is genuine and well‑documented, SEA becomes a useful duty‑efficient hedge to China for commodity grades.

European Union (illustrative). The EU follows a “top‑up to 15%” rule relative to the item’s MFN. If a chemical carries ≈6.5% MFN, the incremental top‑up is 8.5%. On a $1,200/t customs value, that adds ≈ $102/t in addition to MFN and any other overlays (AD/CVD/232).

Takeaway: with these inputs, SEA true origin and China (if at 10–30%) deliver the smallest duty adders on commodity polyols; India and Brazil at 50% are priced out of most U.S. value‑segment business; the EU remains competitive where quality and service premia justify the incremental duty.

Duty cheat‑sheet — Incremental EO layers (on customs‑value proxies)

*EU incremental top‑up assumes MFN ≈6.5% and tops total to 15%; if MFN ≥15%, additional duty is zero.

Upstream → downstream transmission

The 2025 duty framework changes where PPG and PU materials are sourced, how quickly those changes flow through contracts, and which downstream categories feel the squeeze first. Because the incremental tariffs apply to the customs value, the transmission is mechanical: the duty is a percentage adder on the appraised import value, then everything else stacks on top. Upstream price gaps by origin are therefore amplified as product moves through systems houses into mattresses, furniture, footwear, and automotive interiors.

Upstream (polyols): In the United States, procurement tilts toward China and Southeast Asia (SEA) on commodity grades. With China treated operationally at 30% today (10% if the suspension persists; higher if talks sour) and SEA at 19–20% where origin is genuine and auditable, these lanes deliver the lowest duty adders against customs values in the $1.05–1.20k/t band. Here is what that means for a true-origin Southeast Asia mattress program. A Vietnamese mattress assembler sources commodity slabstock polyol around $1,200/t CIF (no U.S. duty at this stage), pours foam locally, and ships finished memory-foam mattresses and toppers to the United States; the U.S. duty is assessed on the finished goods’ customs value, with the SEA reciprocal layer of 9–20% applied to Vietnamese/Indonesian origin (plus whatever MFN/other charges apply to that HTS line). In practical terms, if a boxed mattress declares a $100 customs value, the incremental reciprocal duty adds $19–$20 per unit at the border, often cheaper than a comparable PRC lane at 30% (or higher if talks sour) and dramatically below India/Brazil at 50%, which is why this SEA route is a favored hedge. The lane only works with airtight origin evidence (plant-of-origin documents, foam-pouring and sewing records, and clean routing); if CBP recharacterizes the shipment as PRC origin (e.g., due to misdeclared processing or routing), the importer risks not only the higher China rate but also a +40% transshipment penalty, which flips the economics and can erase margin on an entire program.

The EU remains relevant where performance, lot‑to‑lot consistency, and technical service carry a premium, even though the “top‑up to 15%” rule leaves it costlier than SEA and, in many cases, China . In South America, elevated CFR prints ($1.60–1.70k/t for flexible; $1.58–1.68k/t for rigid) are sustained not just by logistics but by the Brazil AD wall on PRC polyols (typical cash‑deposit levels $1,409–$1,469/t, with one named exporter lower) and AD duties on U .S. suppliers (roughly $555–$680/t). Those measures blunt PRC commodity pricing and keep regional tags structurally above India/SEA benchmarks. Across all lanes, enforcement risk is now a core variable: confirmed transshipment can trigger a +40% punitive duty in addition to the base schedule, instantly erasing any nominal price advantage .

Mid‑stream (systems and CASE): Systems houses importing polyol blends or pre‑polymers feel the tariff immediately because duty is paid on the declared customs value of the mixture, not just the neat polyol. Where formulations are spec‑locked, switching origins or chemistries can take weeks to months, so contract architecture does the heavy lifting. Duty pass‑through clauses tied to HTS code and country of origin, dual‑spec pre‑qualification (EU/SEA alongside China), and time‑phased arrivals around policy dates are the main economic levers. For larger programs, foreign‑trade zone (FTZ) and in‑transit window tactics can smooth step changes while compliance teams validate origin documents down to plant level.

Downstream (mattresses, furniture, footwear, auto seating): At 50% incremental duty, Brazil and India are largely priced out of U.S. value‑segment imports unless buyers are locked into tooling or proprietary systems. To show how this plays out at product level, consider a U.S. footwear brand importing finished PU footwear from Brazil. A Brazil-based footwear supplier that sources polyols domestically pays regional CFR levels supported by Brazil’s anti-dumping wall against PRC polyols (typical cash deposits ≈$1.41–$1.47k/t). When those finished PU goods ship to the U.S., they face an additional 50% duty stack (Brazil +40% national-emergency layer that can stack with the reciprocal schedule, often +10%). On a $20/pair customs value, the incremental duty adds ≈$10/pair before MFN/fees, erasing price competitiveness unless the buyer is locked into proprietary tooling or pays up for continuity. The practical responses are (i) move final assembly to a USMCA site to change origin, or (ii) pivot volume to Mercosur/LatAm retail where the U.S. duty does not apply.

That volume reorients to domestic and regional channels, which can pressure local prices unless internal demand expands. By contrast, China (30%) and SEA (19–20%) lanes inherit more U.S. demand provided origin evidence is watertight. On the customs‑value proxies in play, every +10 percentage points of duty adds roughly $110–$160 per tonne upstream; by the time that rolls through foam density, scrap rates, and conversion costs, it shows up as several dollars per finished unit in mattresses and footwear, and larger line‑item moves in automotive seating.

Trade diversion and share shifts (next 3–6 months)

The fastest changes will appear in spot buys and short‑cycle contracts. U.S. buyers of commodity polyols will steer toward China (treated in operations at 30% extra duty) for scale and speed, and toward Southeast Asia (19–20%) where factory origin is clearly documented. The EU will retain specialty and spec‑locked business under the “top‑up to 15%” rule, rarely the cheapest, but preferred where performance and consistency matter.

Brazil and India are largely priced out of U.S. commodity polyol and PU shipments at 50% extra duty. Most of that volume will be redirected to domestic or regional customers. Where feasible, some exporters will shift finishing to Mexico/USMCA to change country of origin and lower duties on downstream goods.

Within South America, Brazil’s anti‑dumping duties on Chinese polyols block cheap PRC material and help keep CFR $1.60–$1.70k/t pricing in place even though Asia is softer. Brazilian producers defend share behind that wall; converters needing extra supply look to non‑Chinese origins in Mercosur or the rest of the world. Elsewhere in the region (outside Brazil), Chinese origin remains accessible and continues to serve local converters where no AD barrier exists.

Two practical limits constrain share shifts. First, origin enforcement: U.S. Customs can add a +40% penalty for proven transshipment, so “paper SEA” lanes will not pass audit—importers need plant‑level origin proof. Second, spec lock‑in: many downstream products are qualified to specific polyols or systems, so switching takes time. Most buyers will dual‑source (China + SEA or EU) while they work through approvals.

P&L impact and pricing transmission

Tariff incidence dominates earnings more than week‑to‑week spot moves. On a $1,100–$1,600 per‑ton customs value, every additional 10 percentage points of duty adds roughly $110–$160/t (about $0.05–$0.07/lb) to landed cost. Using the established midpoints and customs‑value proxies, duty burden per origin is: China at 30% ≈ $345/t ($0.16/lb); China at 10% ≈ $115/t ($0.05/lb); China at 34% ≈ $391/t ($0.18/lb); Southeast Asia at 19–20% ≈ $210–$220/t ($0.10/lb); India and Brazil at 50% ≈ $550–$800/t ($0.25–$0.36/lb); and, for an EU chemical with MFN near 6.5%, the reciprocal “top‑up to 15%” adds $102/t ($0.05/lb) incremental (MFN and any AD/CVD/232 are separate overlays). In value segments such as flexible foam, a $200–$350/t duty swing can compress gross margin by 300–600 bps unless list prices are adjusted quickly, given raw materials typically account for 50–70% of COGS. Compression occurs fastest where contracts lack tariff pass‑through mechanisms or where delivered (DDP) pricing is fixed.

Risk planning must include outcomes beyond the published band. Alongside the 10% / 30% / 34% cases for China, a stress case in which bilateral relations deteriorate and China‑specific duties revert toward triple‑digits (≥100%) should be considered. On a $1,150/t customs base, a 100–125% rate adds $1,150–$1,440/t ($0.52–$0.65/lb), erasing the PRC landed‑cost edge instantly and forcing rotation to SEA/EU/domestic supply with longer lead times, higher working capital, and temporary margin pressure during the transition.

Country lenses that drive decisions

Brazil: At an effective 50% U.S. duty stack, Brazil‑origin polyols and downstream PU goods are structurally uncompetitive in U.S. commodity segments. Regionally, CFR benchmarks in South America remain elevated in part because the Brazil AD wall blunts the pass‑through of lower Asian values. The likely near‑term response is a pivot toward Mercosur and neighboring markets, plus selective finishing shifts into USMCA locations where economics justify requalification under new origin rules.

India: The combined 50% U.S. add‑on redirects India’s export focus toward Asia and the Middle East/Africa while domestic converters continue to source polyols near $ 1.20–$ 1.35k/ t CIF to feed a large downstream base. In chains where the United States is a price‑setting end‑market, value mix and margins will matter more than volume until tariff visibility improves. A current example from automotive illustrates the magnitude of the penalty. An Indian systems house shipping molded PU seat cushions to a U.S. Tier-1 faces an incremental 50% duty (reciprocal +25% plus Russia-oil +25%) on the customs value of the finished article. On a $3.20/cushion customs value, the duty adds ≈$1.60/cushion—too large to absorb in value models. Most programs either (i) dual-source from SEA/EU, (ii) relocate finishing to Mexico to change origin, or (iii) re-price with automatic tariff pass-through clauses indexed to HTS and origin.

China: With a working assumption of 30% incremental duty during the negotiation window, China gains near‑term share in U.S. commodity polyols and certain PU intermediates on volume, cost, and speed. The key variable is the November 10 timeline: an extension sustains current spreads; a reversion toward 34% narrows, but does not erase, China’s advantage versus true‑origin Southeast Asia; a hardening beyond prior peaks would quickly push demand toward SEA, EU, Mexico, or U.S. domestic supply. A live appliance-foam example shows how the scenario ladder drives sourcing. A U.S. appliance plant buying Chinese foam systems at a customs base ≈$1,150/t currently budgets 30% (≈$345/t) and beats EU/SEA on speed. If talks extend (10%), duty drops to ≈$115/t and PRC becomes the clear low-cost lane. If the rate reverts toward 34%, the adder rises to ≈$391/t; PRC still competes but SEA narrows the gap. In a stress case (≥100%), the adder jumps to ≥$1,150/t, forcing an immediate shift to SEA/EU/domestic with higher working capital and a temporary squeeze on gross margins during changeover.

European Union: The “top‑up to 15%” rule keeps EU supply viable in specialties, systems, and spec‑locked materials where technical service and performance justify a $100–$300/t disadvantage. EU is unlikely to lead on commodity price against China 30% or SEA 19–20% but remains central to dual‑source strategies that hedge policy and quality risk.

Southeast Asia (true origin): Duty loads around 19–20% create a durable hedge to China for commodity grades, provided origin is authentic and audit‑ready. Given CBP’s transshipment stance (punitive +40% if evasion is proven), plant‑level documentation and consistent routing are prerequisites to scale these lanes.

Risk, compliance, and the operating playbook

Two execution risks dominate: policy timing and origin enforcement. The November decision on China is a discrete pricing event that should be managed with staged arrivals and flexible Incoterms rather than emergency re‑sourcing. On enforcement, documentation must stand up to scrutiny; the cost of a misstep is not just duty repayment but potential penalties and loss of supply continuity.

Operating spine:

Assumptions and notes

Currency conversions use ¥7.20/$ as a working rate. Customs‑value proxies subtract $100/t from CIF/CFR to approximate the dutiable base; replace with lane‑specific freight and insurance to refine. Brazil’s anti‑dumping cash‑deposit levels for China‑origin polyols are ≈$1,408.70–$1,469.16/t for most named exporters (one notable at $959.19/t). MFN (Column 1), Merchandise Processing Fee (0.3464%), Harbor Maintenance Fee (0.125%), Section 232, and any AD/CVD are separate from the incremental executive‑order adders discussed here; final economics remain HTS‑ and origin‑specific.

Turn tariff volatility into an edge with PUdaily Pricing Intelligence

Given these unpredictable dynamics, access to accurate, real-time market intelligence has become essential. PUdaily’s Pricing Intelligence Service and dedicated Asia-Pacific PPG reports help industry participants anticipate shifts, benchmark prices, and make better-informed procurement and sales decisions amid the uncertainty.