In July 2025, China imported 160 tonnes of TDI, up 10.51% month-on-month (MoM) but down 82.77% year-on-year (YoY), according to data by the General Administration of Customs.

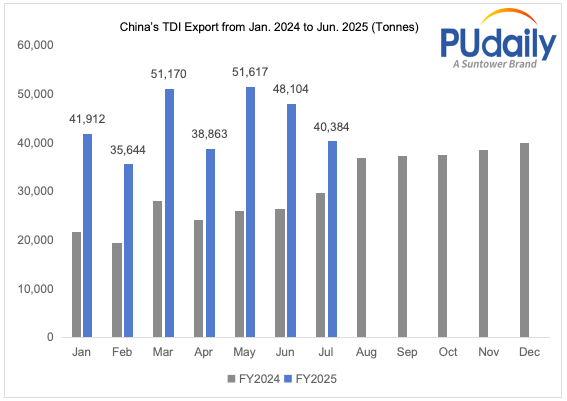

China exported 40,384 tonnes of TDI in July 2025, a 16.05% decline MoM but a 35.60% increase YoY.

Table 1 China’s TDI Imports & Exports, 2024-2025 (tonne)

| Month | Import Volume | Export Volume | ||||||

| 2024 | 2025 | YoY Change | MoM Change | 2024 | 2025 | YoY Change | MoM Change | |

| Jan. | 1,160 | 280 | -75.90% | -75.10% | 21,749 | 41,912 | 92.70% | 4.50% |

| Feb. | 1,992 | 260 | -86.90% | -7.10% | 19,562 | 35,644 | 82.20% | -15.00% |

| Mar. | 3,140 | 290 | -90.80% | 11.50% | 28,062 | 51,170 | 82.30% | 43.60% |

| Apr. | 2,503 | 120 | -95.20% | -58.60% | 24,258 | 38,863 | 60.20% | -24.10% |

| May | 660 | 85 | -87.10% | -29.20% | 26,010 | 51,617 | 98.50% | 32.80% |

| Jun. | 2,182 | 145 | -93.40% | 70.60% | 26,486 | 48,104 | 81.60% | -6.80% |

| Jul. | 929 | 160 | -82.80% | 10.30% | 29,781 | 40,384 | 35.60% | -16.00% |

| Aug. | 1,747 | 37,007 | ||||||

| Sep. | 1,364 | 37,302 | ||||||

| Oct. | 1,220 | 37,656 | ||||||

| Nov. | 245 | 38,559 | ||||||

| Dec. | 1,124 | 40,089 | ||||||

| Total (Jan-Jul) | 12,566 | 1,340 | -89.30% | - | 175,908 | 307,694 | 74.90% | - |

Figure 1: China’s Monthly TDI Exports, 2023-2025 (tonne)

Table 2. China’s TDI Export Destinations & Export Volumes, Jan.-Jul. 2025 (tonne)

| Destination | Export Volume | Share |

| Indonesia | 30,290 | 9.80% |

| Vietnam | 28,949 | 9.40% |

| Brazil | 16,913 | 5.50% |

| India | 16,395 | 5.30% |

| Nigeria | 14,040 | 4.60% |

| Turkey | 12,170 | 4.00% |

| Kenya | 11,040 | 3.60% |

| Russia | 9,933 | 3.20% |

| Argentina | 9,481 | 3.10% |

| Columbia | 8,625 | 2.80% |

| Others | 149,858 | 48.70% |

| Total | 307,694 | 100.00% |

China’s TDI exports from January to July totaled 307,694 tonnes, up 74.9% year-on-year versus the same period in 2024. Full-year exports are expected to register substantial YoY growth.

Given these unpredictable dynamics, access to accurate, real-time market intelligence has become essential. PUdaily’s Pricing Intelligence Service and dedicated Asia-Pacific TDI reports help industry participants anticipate shifts, benchmark prices, and make better-informed procurement and sales decisions amid the uncertainty.