China's TDI Market Saw a Significant Pullback in August. The supply side in August was characterized by a mix of bullish and bearish factors. On one hand, Wanhua Chemical's Yantai TDI plant began maintenance on August 19th, and Gansu Yinguang's plant restart was delayed until late August. On the other hand, the commissioning of the second phase of Wanhua's Fujian plant offset some of the supply gap. However, due to a force majeure at its German supplier lasting longer than expected, Covestro reduced its supply volume twice within the month.

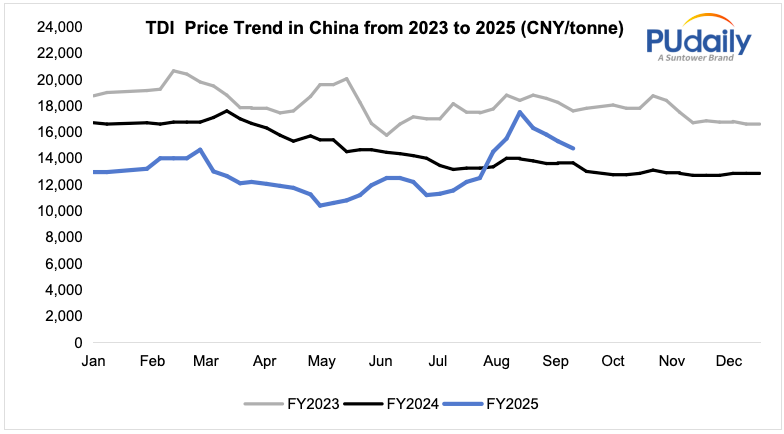

Demand remained lackluster. Downstream customers showed significant resistance to high prices, with most opting for a cautious, wait-and-see approach, leading to sparse actual order negotiations. Traders faced continuous pressure to ship goods and were forced to repeatedly offer concessions to close deals. This, combined with profit-taking from lower-cost inventory, caused a broad downward shift in the market price center. As of the end of August, the Chinese market price had fallen to approximately 14,500-15,000 CNY/tonne, a decrease of 2,000 CNY/tonne from the beginning of the month.However, due to a steeper price hike from late July to early August, the average price for August was still 2,000 CNY/tonne higher than the monthly average for July.

China TDI market is expected to fluctuate weakly in September. The overall spot supply in the market is expected to increase, and the positive momentum from the supply side may be exhausted. Although downstream industries such as sponges and coatings are entering the traditional peak season of "Golden September, Silver October," resistance to current prices persists. It is anticipated that purchasing will primarily be based on essential needs, with a significant increase in volume unlikely. Traders remain cautious and are not optimistic. The TDI price is expected to fluctuate in September following the recent decline. Market watchers should pay close attention to the settlement price guidance from major manufacturers at the end of the month and the substantive recovery of downstream demand.

Given these unpredictable dynamics, access to accurate, real-time market intelligence has become essential. PUdaily’s Pricing Intelligence Service and dedicated Asia-Pacific TDI reports help industry participants anticipate shifts, benchmark prices, and make better-informed procurement and sales decisions amid the uncertainty.