Upholstered furniture refers to furniture added with padding, foam, fabric and other materials. This involves sofas, upholstered beds, mattresses, nightstands, coffee tables and other relative products. Among them, mattresses and sofas are the two main types of upholstered furniture. The industrialization of upholstered furniture began in Europe in the early 20th century. Global upholstered furniture industry has greatly increased its production capacity thanks to continuously advanced manufacturing technologies, and the market demand has also kept growing.

As the upholstered furniture industry is labor-intensive, developed countries are continuing to transfer their manufacturing to developing countries, which have low labor costs and sufficient raw materials. The main upholstered furniture manufacturing countries currently include China, U.S., Poland, India, Italy, and Germany.

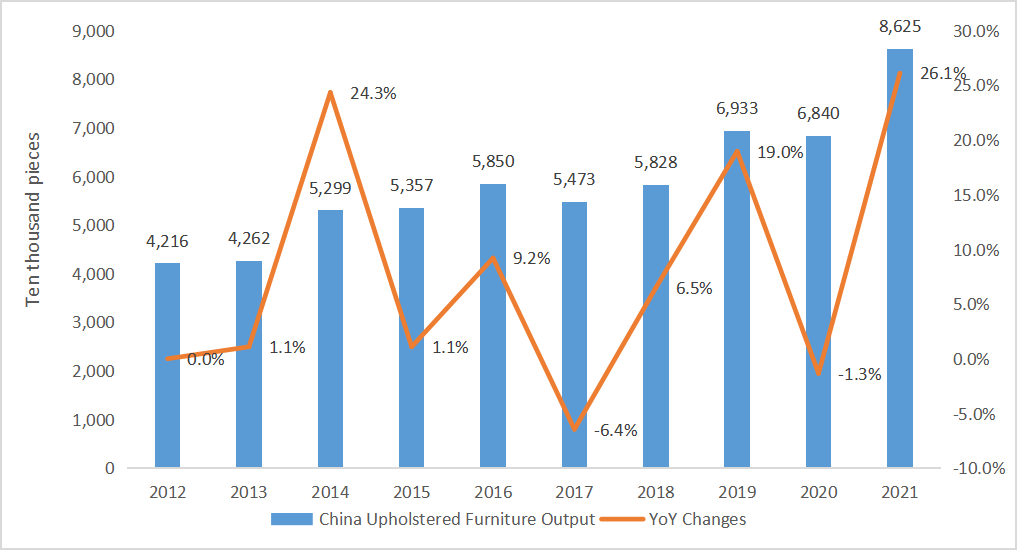

China has become one of major producers and consumers of upholstered furniture. China’s modern upholstered furniture industry began in the early 1980s. In recent years, through introduction of advanced furniture design technology and processing technology from abroad, and on the basis of fully leveraging the advantages of raw material resources and labor costs, China’s upholstered furniture industry has developed rapidly. At present, China’s upholstered furniture output value makes up 46.4% of the world, contributing about 30.7% of the global upholstered furniture consumption.

Figure 1 China Upholstered Furniture Outputs & YoY Changes, 2012-2021

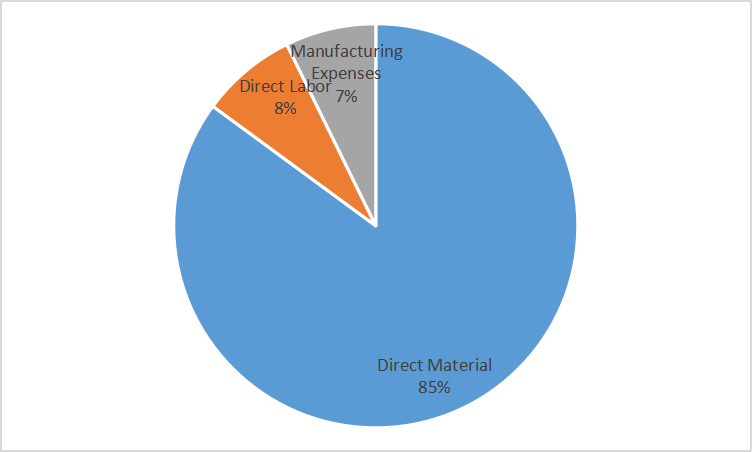

The upholstered furniture industry has a long industrial chain that spans agriculture, manufacturing, and retail industries. Its upstream industries mainly include leather, wood, foam, and other raw material industries. Downstream manufacturers mainly sell products to end consumers through channels such as dealers, ODMs, and direct-sale stores. Leather is mainly used for the outer surface of upholstered furniture, primarily natural cowhide. Wood is mainly used for the main structure of upholstered furniture, and the development of forest planting directly affects the wood supply and procurement costs of the upholstered furniture industry. Foam, namely polyurethane foam, is a typical cushioning material mainly used for cushions, armrests, backrests, etc., to improve the softness and comfort of upholstered furniture. It is made from polyurethane through processes such as foaming, hot pressing, and cutting, and is a derivative product in the petrochemical processing industry. Therefore, its price is greatly affected by fluctuations in oil prices. Downstream manufacturers of upholstered furniture mainly sell products to end users through direct-sale stores, dealers, etc., and factors such as household income and real estate industry development drive consumer demand.

Commodity prices have risen sharply since 2021. The low added value and high cost of the upholstered furniture industry have been greatly affected by rising raw material prices. Meanwhile, under the policy of “housing is for living, not for speculation”, the prosperity of the real estate industry has significantly declined, which also brings obvious suppression on the demand for upholstered furniture. Under the dual impact of rising costs and weakening demand, the overall profit margin of the upholstered furniture industry has significantly decreased. Especially for small and micro manufacturers that rely on price advantages, their survival space has been squeezed.

Figure 2 Cost Structure of a Mattress Manufacturer

In the future, China’s upholstered furniture industry could follow two important directions:

1) A boom in established market:

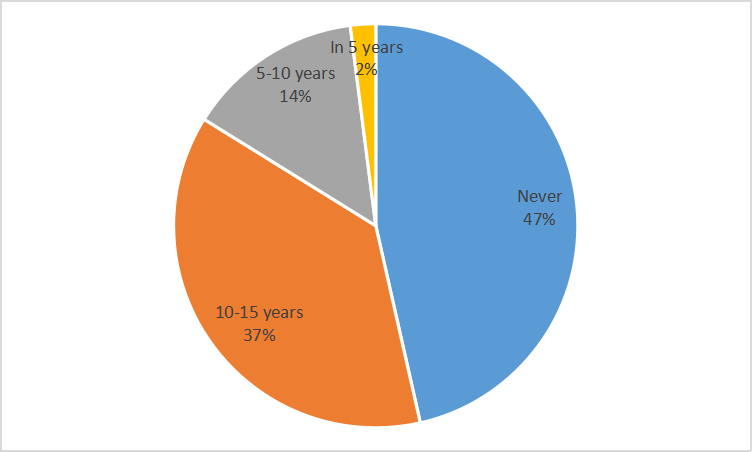

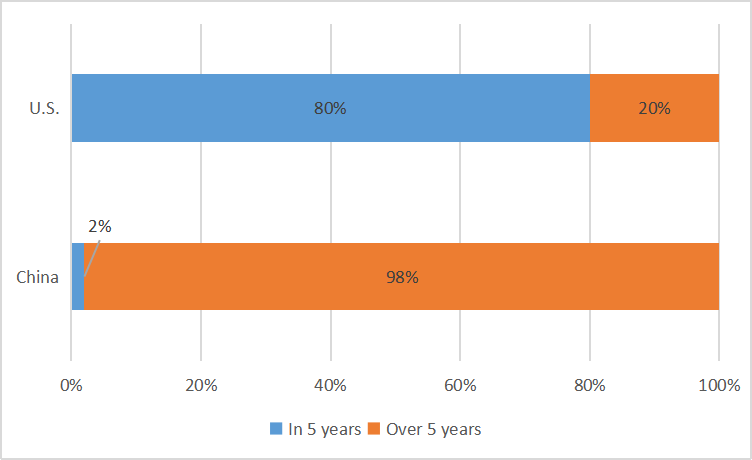

A few decades ago, spring mattresses were popularized in China. For a spring mattress, the lifespan of spring is usually 10-20 years, and that of filler and fabric is about 5-10 years. At present, the frequency of mattress replacement in China is much lower than that in U.S. 37% of Chinese consumers replace mattresses in 10-15 years, while 47% of consumers have never changed them, which are mostly under serviceability limit state. We believe that increasingly frequent mattress replacement and higher requirements for comfort level of beddings may boost the demand for mattresses.

Figure 3 Mattress Replacement Frequency in China

Figure 4 Comparison of Mattress Replacement Frequency in China and U.S.

2) Rising industrial concentration:

At present, China’s sofa industry is fragmented. CR4 (the concentration ratio of the top four manufacturers) in China was only 30% in 2021, with Man Wah holding the largest market share (about 12%); the concentration of U.S. sofa industry was higher, with CR4 reaching 51% and CR10 reaching 79% in 2017, and the market share of top manufacturers la-z-boy/Ashley/Man Wah reached 21%/11%/10% respectively.

In terms of the mattress industry, the U.S. market is dominated by a few top brands, while Chinese mattress market is inundated with small and medium-sized manufacturers.

The top 5 brands in U.S., (CR5), Sealy, Simmons, Serta, Tempur-Pedic and Sleep Number, together occupied 69.40% of the mattress market. CR3 and CR8 in China’s mattress market are only 11.43% and 18.66%. The market share of top three brands - Sleemon, Serta and DeRucci - is 4.38%, 3.88% and 3.17% respectively.

With the improvement of residents’ consumption levels and the broad demand for mattress replacement, top manufacturers with advantages in brand, channels, and services are expected to usher in a significant growth in the next few years.