2023 has come and gone in a rush. In the past year, the US housing market witnessed a notable storm, with one of the most talked-about topics being the skyrocketing mortgage rates. Since the end of 2022 when the 30-year fixed mortgage rate broke 6% for the first time, it climbed to over 7% in 2023, and even approached the high of 8%, undoubtedly shattering many people’s home-buying dreams. At this point, rumours about the burst of housing bubble spread everywhere. Looking back, to find a similar scenario of high mortgage rates, we have to go back over 20 years to the turn of the century. Over the years, people have gradually grown accustomed to a low interest rate environment. Since the real estate market recovery in 2012, the average 30-year mortgage rate has only been 4.14%, making the current figure of over 7% exceptionally glaring.

Despite the record-high mortgage rates in 2023, housing prices did not fall as expected, but instead continued to stand firm. An expert pointed out, “High rates reduce housing demand, but also more significantly reduce housing supply”. The US housing inventory is only equivalent to a 2.5-month supply at the current sales pace, far below the balanced level of 6-month.

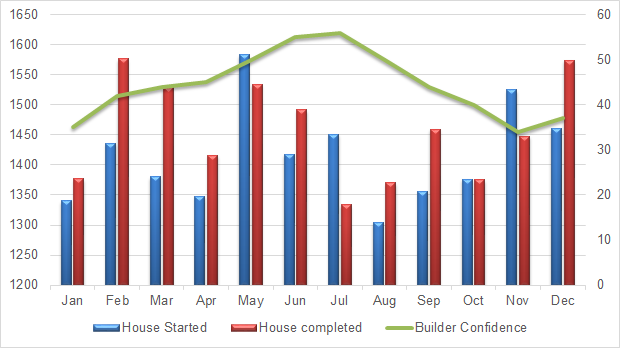

In 2023, housing starts in the US totaled 16.98 million, a year-on-year decrease of 8.8%, according to FRED. Meanwhile, housing completions increased by 5.5% to 17.48 million. In addition, the Housing Market Index (HMI) published by the National Association of Home Builders (NAHB) dropped to 44% in 2023, a 15% decrease from the previous year, further confirming the view that “high rates reduce housing demand, but also more significantly reduce housing supply”.

Figure 1: US Housing Completions, Housing Starts & HMI 2023 (1,000 units, %)

Data source: FRED, NAHB

In 2023, the available housing inventory was relatively low due to sellers unwilling to give up previously locked-in low interest rates. Luckily, in 2024, buyers can expect to see an improvement in the number of homes for sale. Lawrence Yun, chief economist at National Association of Realtors (NAR), stated that overall housing inventory could increase by as much as 30%, with some markets experiencing even more rapid growth.

The number of mortgage applications for home purchases in the US rose to the highest level since April 2023, indicating an increase in housing loan demand due to borrowing costs remaining below 7%. Data from the Mortgage Bankers Association (MBA) showed that mortgage applications for home purchases in the US increased 7.5% to 174.3 in the week ended January 19. Real estate websites like Zillow predicted that rates will remain between 7% and 7.5% throughout the year, while NAR was more optimistic, expecting rates to average below 7% in early spring (home buying season) and to drop to around 6.3% by the end of the year. In contrast, Realtor.com predicted that rates would average 6.5% by the end of 2024.

In summary, with mortgage rates averaging 6.61% and trending downward by the end of December, the US real estate market may experience a recovery in 2024.